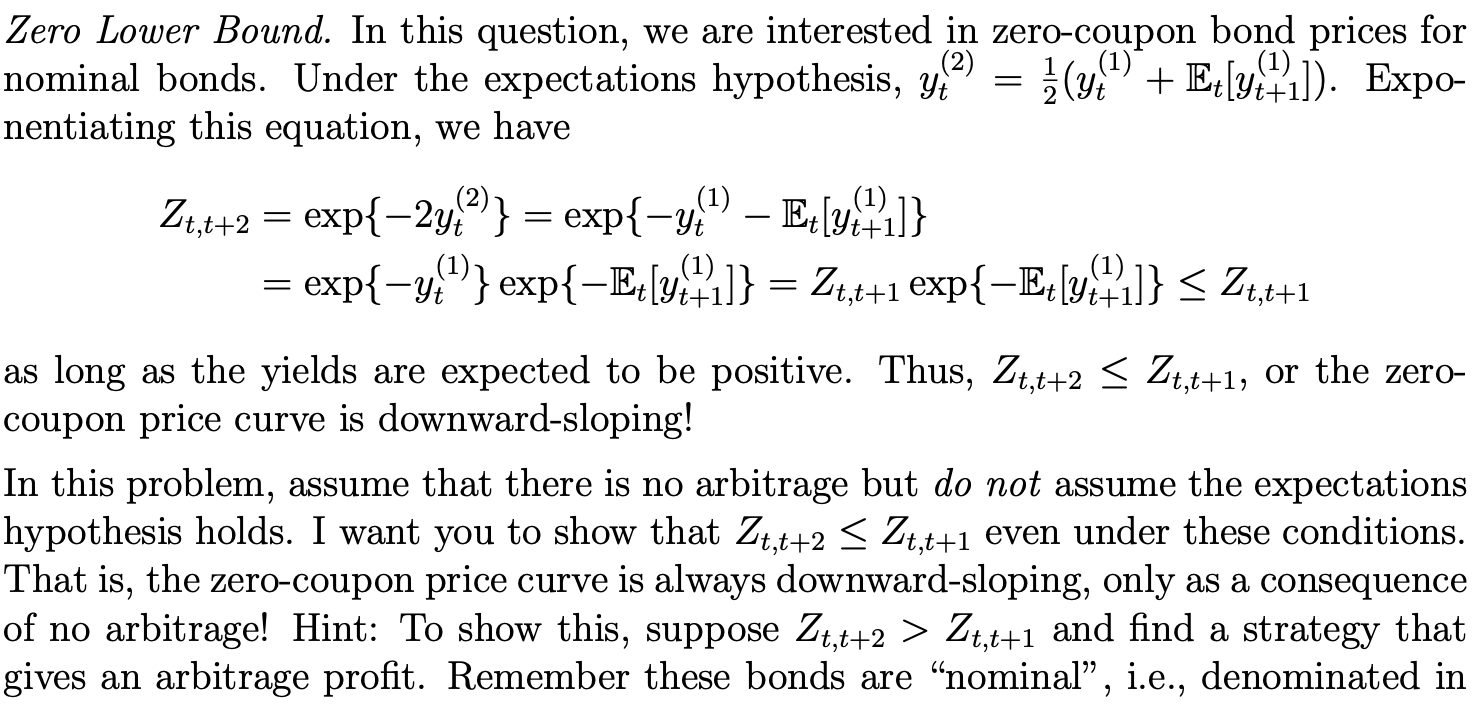

Question: (2) = Zero Lower Bound. In this question, we are interested in zero-coupon bond prices for nominal bonds. Under the expectations hypothesis, y 2(y: +

(2) = Zero Lower Bound. In this question, we are interested in zero-coupon bond prices for nominal bonds. Under the expectations hypothesis, y 2(y:" + Ex[9+]). Expo- nentiating this equation, we have Z1,4+2 = exp{-24?)} = exp{-4") E[y{1}]} exp{-y_"}} exp{-E,[41]} = 21,1+1 exp{-E,[97]} 21,6+1 and find a strategy that gives an arbitrage profit. Remember these bonds are "nominal, i.e., denominated in (2) = Zero Lower Bound. In this question, we are interested in zero-coupon bond prices for nominal bonds. Under the expectations hypothesis, y 2(y:" + Ex[9+]). Expo- nentiating this equation, we have Z1,4+2 = exp{-24?)} = exp{-4") E[y{1}]} exp{-y_"}} exp{-E,[41]} = 21,1+1 exp{-E,[97]} 21,6+1 and find a strategy that gives an arbitrage profit. Remember these bonds are "nominal, i.e., denominated in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts