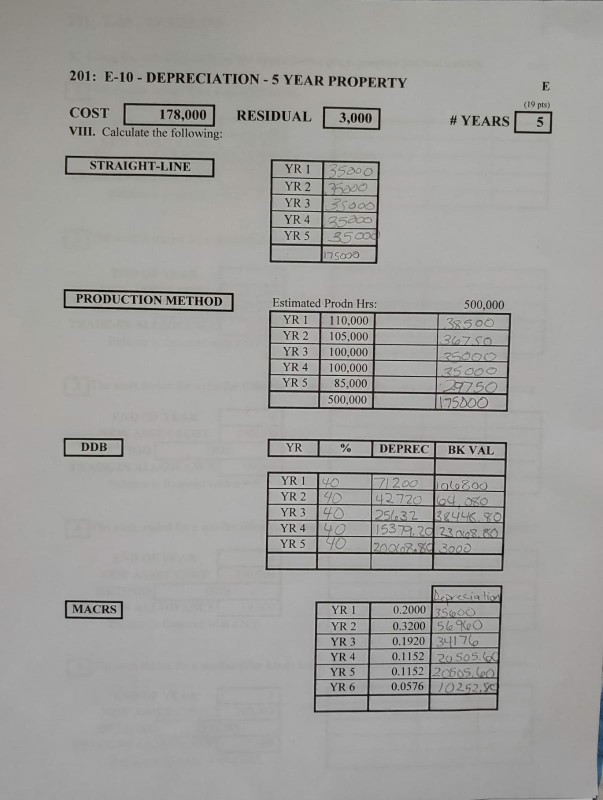

Question: 201: E-10 - DEPRECIATION - 5 YEAR PROPERTY (19 pts COST 178,000 VIII. Calculate the following: RESIDUAL 3,000 # YEARS 5 STRAIGHT-LINE YRI 35000 YR

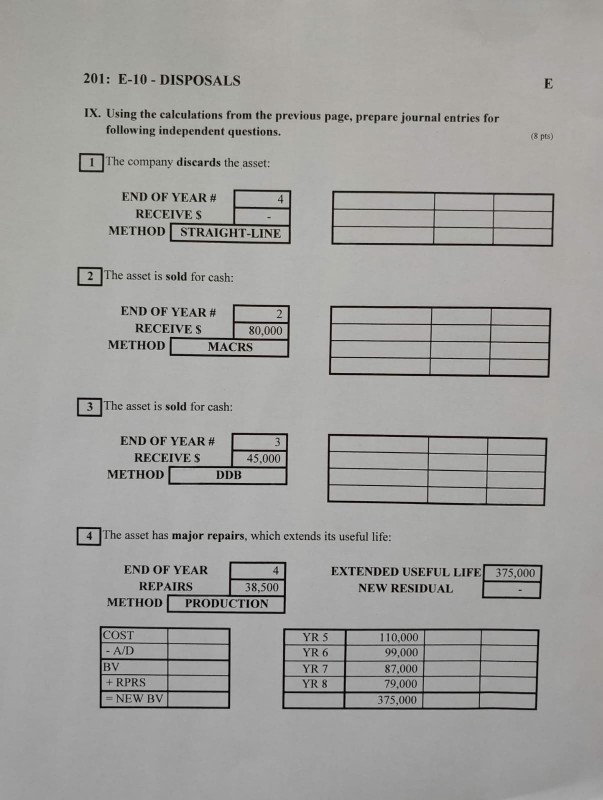

201: E-10 - DEPRECIATION - 5 YEAR PROPERTY (19 pts COST 178,000 VIII. Calculate the following: RESIDUAL 3,000 # YEARS 5 STRAIGHT-LINE YRI 35000 YR 23500 YR33SDOO YR 4 252 YR 535000 75000 PRODUCTION METHOD 500,000 38 500 37. SO Estimated Prodn Hrs: YRI 110.000 YR 2 105,000 YR 3 100,000 YR 4 100,000 YR 5 85,000 500,000 25 000 12750 125000 DDB YR % DEPREC BK VAL YRI 4 YR 2 190 YR3 40 YR 4140 YR 5 90 71200800 TL 7 42.720 lod.OKO 25632 38446.80 1532.20 2 0 5 200% x 300 MACRS YRI YR 2 YR 3 0.2000 35000 0.3200 56 40 0.1920 34176 0.115220 Sos.co 0.1152 20505.00 0.0576 10252.90 YR 4 YR 5 YR O 201: E-10 - DISPOSALS IX. Using the calculations from the previous page, prepare journal entries for following independent questions. (ps) 1 The company discards the asset: END OF YEAR # RECEIVES METHOD STRAIGHT-LINE 2 The asset is sold for cash: END OF YEAR# RECEIVES 80,000 METHOD MACRS 3 The asset is sold for cash: END OF YEAR # RECEIVES 45.000 METHOD O DDB 4 The asset has major repairs, which extends its useful life: END OF YEAR REPAIRS 38,500 METHOD PRODUCTION EXTENDED USEFUL LIFE 375,000 NEW RESIDUAL COST -AD YR 5 YR 6 YR 7 YR 8 BV 110,000 99,000 87,000 79000 375,000 + RPRS - NEW BV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts