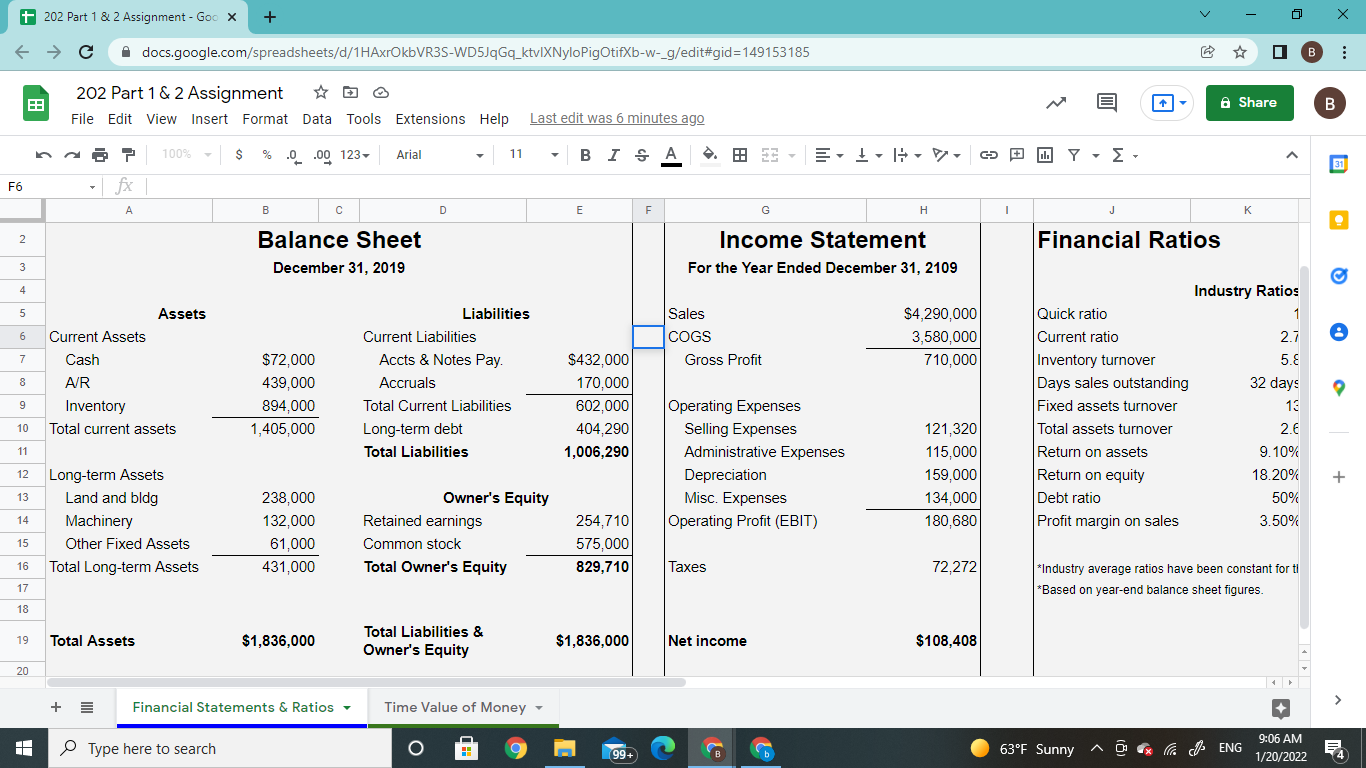

Question: + 202 Part 1 & 2 Assignment - Goo X + o X + = Financial Statements & Ratios Time Value of Money Type here

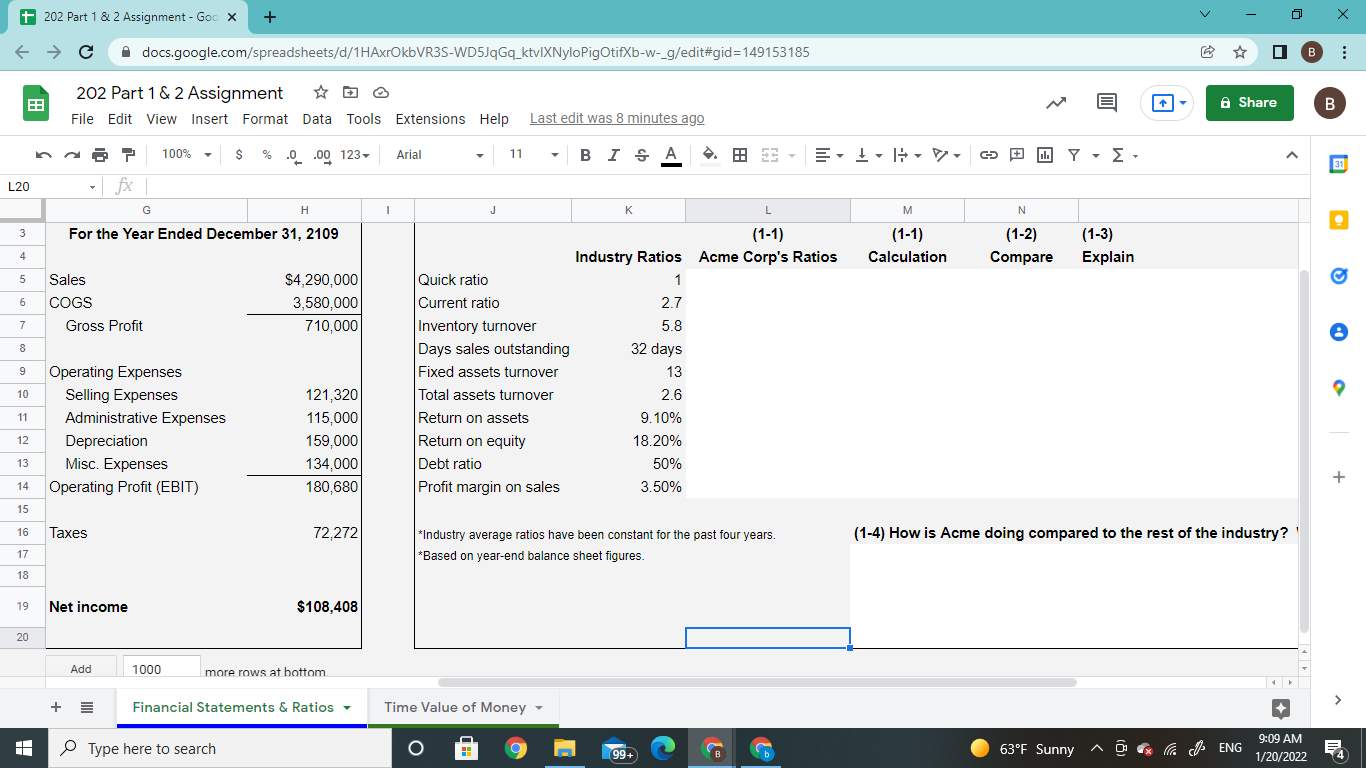

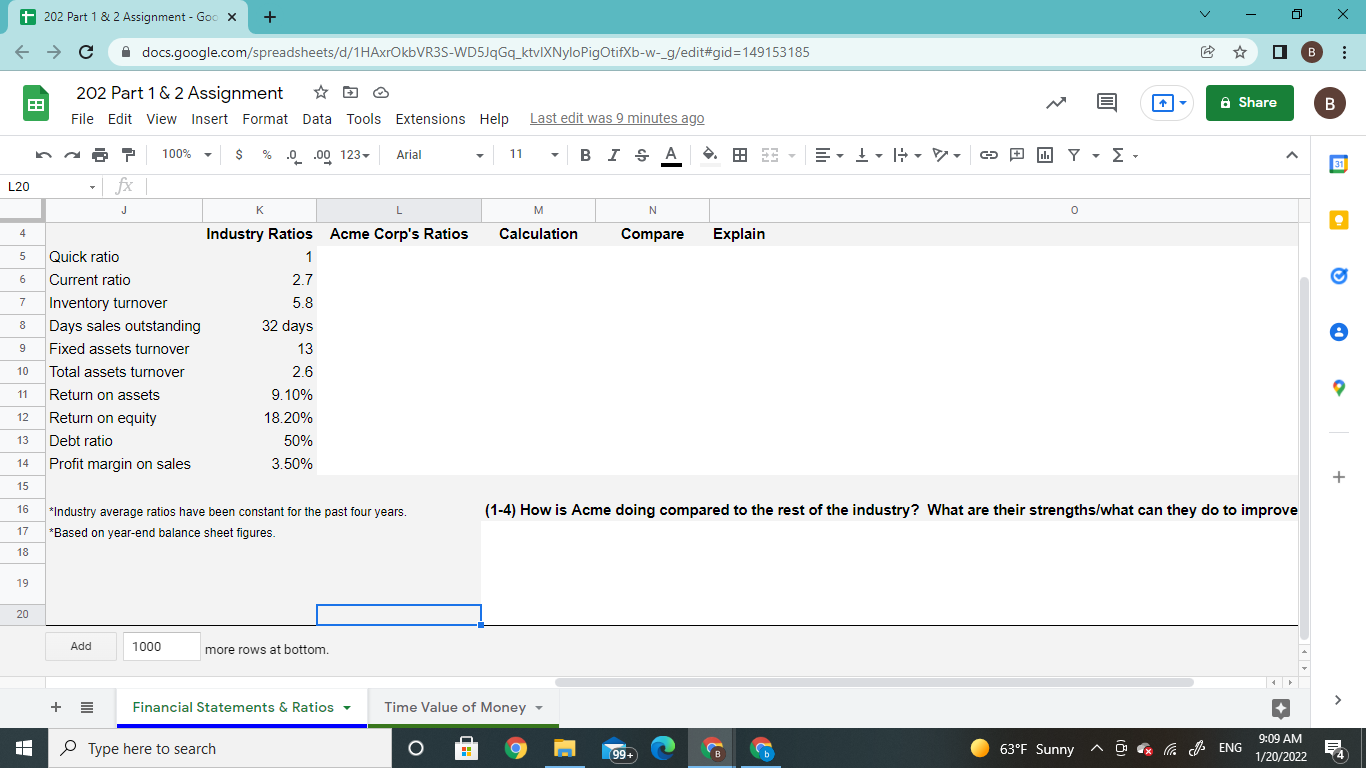

+ 202 Part 1 & 2 Assignment - Goo X + o X + = Financial Statements & Ratios Time Value of Money Type here to search 63F Sunny Ta JENG 9:06 AM 1/20/2022 199+ 4 + 202 Part 1 & 2 Assignment - Goo X + o X docs.google.com/spreadsheets/d/1HAxrOkbVR3S-WD5qGq_ktvIXNylo PigotifXb-w-_g/edit#gid=149153185 I B : ES 202 Part 1 & 2 Assignment File Edit View Insert Format Data Tools 1) A Share B Extensions Help Last edit was 8 minutes ago 100% $ % .0 .00 123- Arial 11 BIS .: E I. GE ul. - - L20 fx G H 1 J L M N 3 For the Year Ended December 31, 2109 (1-1) Acme Corp's Ratios (1-1) Calculation (1-2) Compare (1-3) Explain 4 5 6 Sales COGS Gross Profit $4,290,000 3,580,000 710,000 7 8 9 Industry Ratios Quick ratio 1 Current ratio 2.7 Inventory turnover 5.8 Days sales outstanding 32 days Fixed assets turnover 13 Total assets turnover 2.6 Return on assets 9.10% Return on equity 18.20% Debt ratio 50% Profit margin on sales 3.50% 10 Operating Expenses Selling Expenses Administrative Expenses Depreciation Misc. Expenses Operating Profit (EBIT) 11 12 121,320 115,000 159,000 134,000 180,680 13 14 15 16 Taxes 72,272 (1-4) How is Acme doing compared to the rest of the industry?' *Industry average ratios have been constant for the past four years. *Based on year-end balance sheet figures. 17 18 19 Net income $108,408 20 Add 1000 more rows at bottom + = Financial Statements & Ratios Time Value of Money Type here to search E 199+ S 63F Sunny o x la JENG 9:09 AM 1/20/2022 4 + 202 Part 1 & 2 Assignment - Goo X + o " X F + docs.google.com/spreadsheets/d/1HAxrOkbVR3S-WD5qGq_ktvIXNylo PigotifXb-w-_g/edit#gid=149153185 I B : ES 202 Part 1 & 2 Assignment File Edit View Insert Format Data Tools Extensions Help M A Share B Last edit was 9 minutes ago 11 - BI.A ' ES - T- EIG [ii] , 31 M N 0 Calculation Compare Explain na 100% $ % .0 .00 123- Arial L20 fx J K 4 Industry Ratios Acme Corp's Ratios 5 Quick ratio 1 6 Current ratio 2.7 7 Inventory turnover 5.8 8 Days sales outstanding 32 days 9 Fixed assets turnover 13 10 Total assets turnover 2.6 11 Return on assets 9.10% 12 Return on equity 18.20% 13 Debt ratio 50% 14 Profit margin on sales 3.50% + 15 16 (1-4) How is Acme doing compared to the rest of the industry? What are their strengths/what can they do to improve *Industry average ratios have been constant for the past four years. *Based on year-end balance sheet figures. 17 18 19 20 Add 1000 more rows at bottom. > Financial Statements & Ratios Time Value of Money Type here to search E 199+ S 63F Sunny - Ca H ENG 9:09 AM 1/20/2022 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts