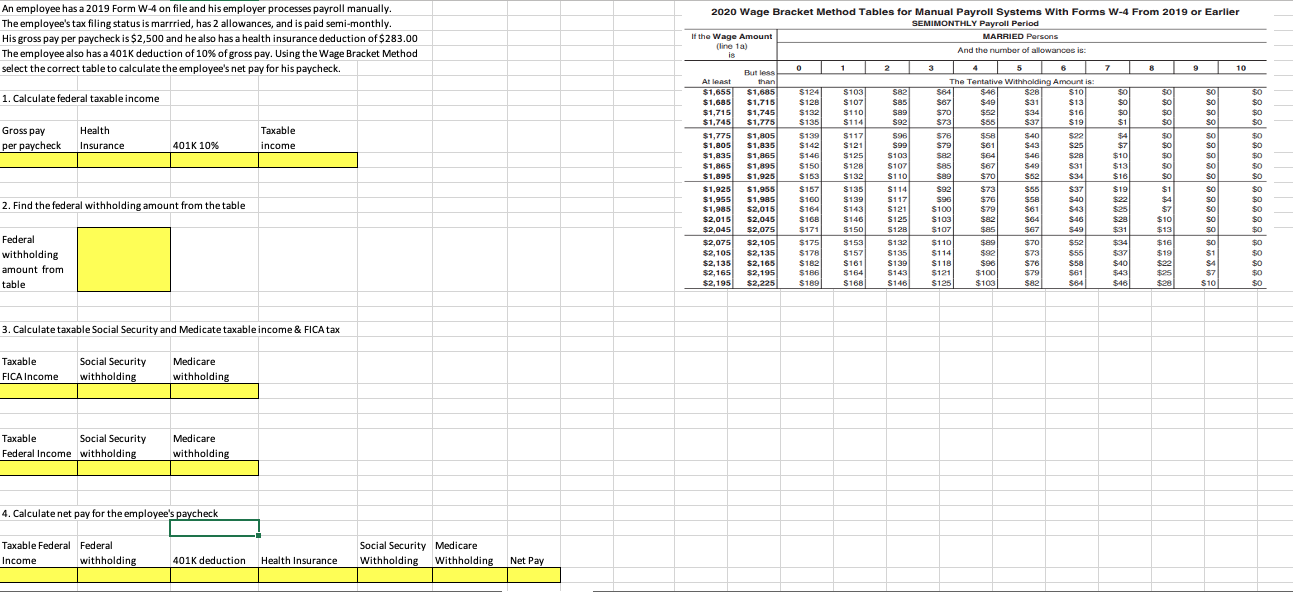

Question: 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier An employee has a 2019 Form W-4 on file

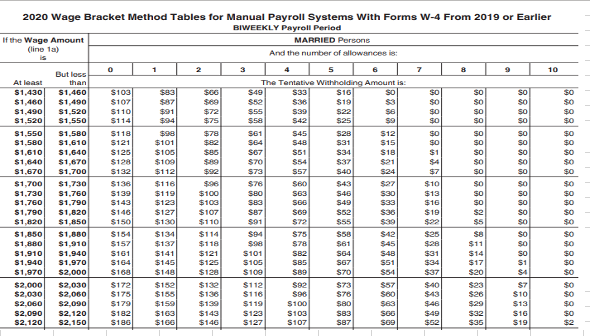

2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier An employee has a 2019 Form W-4 on file and his employer processes payroll manually. SEMIMONTHLY Payroll Period The employee's tax filing status is married, has 2 allowances, and is paid semi-monthly. If the Wage Amount MARRIED Parsons His gross pay per paycheck is $2,500 and he also has a health insurance deduction of $283.00 (line 1a And the number of allowances is is The employee also has a 401k deduction of 10%% of gross pay. Using the Wage Bracket Method 0 1 2 3 5 7 9 10 select the correct table to calculate the employee's net pay for his paycheck. But less At least than The Tentative Withholding Amount is: $1,655 $1,685 $124 $103 $82 $64 $46 $28 $10 $1.685 $1,715 $128 $107 $85 $67 $49 $31 $13 1. Calculate federal taxable income $1,715 $1,745 $132 $110 $89 $70 $52 $34 $16 $1.745 $1,775 $135 $114 $92 $73 $55 $37 $19 Taxable $1,775 $1,805 $139 $117 596 $76 $58 $40 $22 $4 Gross pay Health $1,805 $1,835 $142 $121 $99 $79 $61 $43 $25 $7 per paycheck Insurance 401K 10% income $1,835 $1,865 $146 $125 $103 $82 $64 $46 $28 $10 $1,865 $1,895 $150 $128 $107 $85 $67 $49 $31 $13 $1.895 $1,925 $182 $132 $110 $70 $62 $34 $16 6428 89898 88886 8885 651485888 8898 $1.925 $1,955 $157 $135 $114 $92 $73 $56 $37 $1,955 $1,985 $160 $139 $117 $96 $76 $58 $40 $2,015 $121 2. Find the federal withholding amount from the table $1.985 $164 $143 $100 $79 $61 $43 $2,015 $2,045 $168 $140 $125 $103 $82 $64 $46 $2,045 $2,075 $171 $150 $12B $107 $85 $67 $49 $2,075 $2,105 $175 $153 $132 $110 $89 $70 $52 Federal $2,105 $2,135 $178 $157 $135 $114 $92 $73 $55 withholding $2,135 $2,165 $182 $161 $139 $118 $76 $58 $2,165 $2,195 $186 $164 $143 $121 $100 $79 561 amount from $2,195 $2,225 $188 $168 $146 $125 $10 $82 table 3. Calculate taxable Social Security and Medicate taxable income & FICA tax Taxable Social Security Medicare FICA Income withholding withholding Taxable Social Security Medicare Federal Income withholding withholding 4. Calculate net pay for the employee's paycheck Taxable Federal Federal Social Security Medicare Income withholding 401k deduction Health Insurance Withholding Withholding Net Pay2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier BIWEEKLY Payroll Period If the Wage Amount MARRIED Persons (line 12) Is And the number of allowances is: 0 1 2 3 4 But loss 5 7 10 At least than The Tentative Withholding Amount is: 81.430 $1.460 $103 $48 533 SIG $1,460 $1,490 $107 $1,520 $110 $01 $72 855 822 $1.520 $1,550 5114 675 958 842 925 81.550 81.580 $118 $78 501 545 80 81.580 81,610 $121 $101 548 LES 515 50 51.610 51,640 $125 $105 $07 $34 $1B $1,840 $1,670 $120 $109 $70 SAT Sai $0 81.670 81.700 $132 $112 573 857 540 SO $1,700 $1,730 $118 943 S27 $10 40 81.730 81.760 $119 $100 503 540 530 $13 50 31.760 81.790 $143 $123 $103 583 549 EES $16 $1,780 $1,820 $146 $127 S62 $36 $10 SO $0 $1,830 $1,850 $150 $130 $110 591 $1,050 $1,080 $154 $134 $114 $75 $42 SO $1,880 $1,910 $157 $137 $118 S78 861 $45 50 81.910 81.940 5101 $141 $121 $101 504 548 $31 $14 81.940 81.970 $145 $125 5105 585 $51 317 $1,870 $2,000 $160 $1 10 $128 $109 $70 $3,000 $2,030 $172 $152 $132 $1 12 $73 $40 $2,030 $2,060 $175 $155 $136 $1 10 $76 $60 $43 $26 $TO $2.060 $2,090 $179 $150 $130 $119 $100 983 948 $13 82.090 82,120 $182 $103 $143 $123 5103 583 8GG $49 EES $16 82.120 92.160 $180 $106 $146 $127 5107 587 $36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts