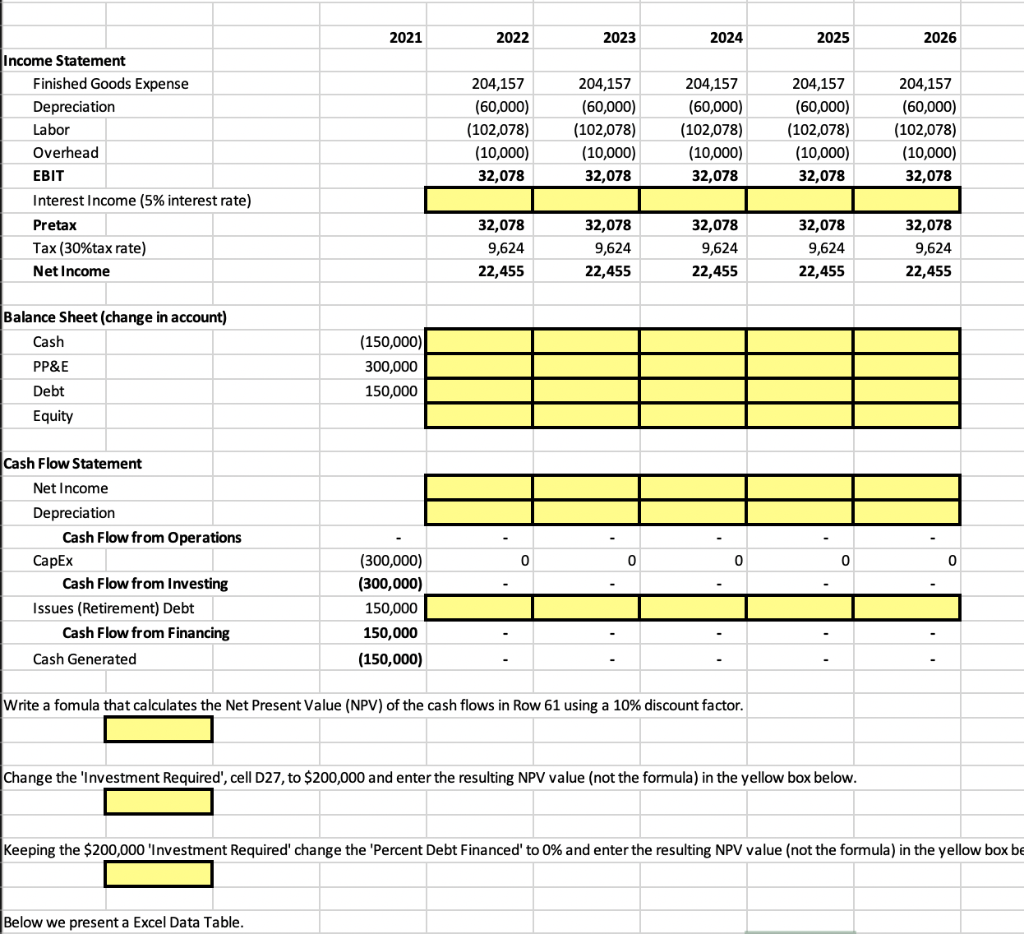

Question: 2021 2022 2023 2024 2025 2026 Income Statement Finished Goods Expense Depreciation Labor Overhead EBIT Interest Income (5% interest rate) Pretax Tax (30%tax rate) Net

2021 2022 2023 2024 2025 2026 Income Statement Finished Goods Expense Depreciation Labor Overhead EBIT Interest Income (5% interest rate) Pretax Tax (30%tax rate) Net Income 204,157 (60,000) (102,078) (10,000) 32,078 204,157 (60,000) (102,078) (10,000) 32,078 204,157 (60,000) (102,078) (10,000) 32,078 204,157 (60,000) (102,078) (10,000) 32,078 204,157 (60,000) (102,078) (10,000) 32,078 32,078 9,624 22,455 32,078 9,624 22,455 32,078 9,624 22,455 32,078 9,624 22,455 32,078 9,624 22,455 Balance Sheet (change in account) Cash PP&E (150,000) 300,000 150,000 Debt Equity Cash Flow Statement 0 0 0 0 0 Net Income Depreciation Cash Flow from Operations Capex Cash Flow from Investing Issues (Retirement) Debt Cash Flow from Financing Cash Generated (300,000) (300,000) 150,000 150,000 (150,000) Write a fomula that calculates the Net Present Value (NPV) of the cash flows in Row 61 using a 10% discount factor. Change the 'Investment Required', cell D27, to $200,000 and enter the resulting NPV value (not the formula) in the yellow box below. Keeping the $200,000 'Investment Required' change the 'Percent Debt Financed' to 0% and enter the resulting NPV value (not the formula) in the yellow box be Below we present a Excel Data Table. 2021 2022 2023 2024 2025 2026 Income Statement Finished Goods Expense Depreciation Labor Overhead EBIT Interest Income (5% interest rate) Pretax Tax (30%tax rate) Net Income 204,157 (60,000) (102,078) (10,000) 32,078 204,157 (60,000) (102,078) (10,000) 32,078 204,157 (60,000) (102,078) (10,000) 32,078 204,157 (60,000) (102,078) (10,000) 32,078 204,157 (60,000) (102,078) (10,000) 32,078 32,078 9,624 22,455 32,078 9,624 22,455 32,078 9,624 22,455 32,078 9,624 22,455 32,078 9,624 22,455 Balance Sheet (change in account) Cash PP&E (150,000) 300,000 150,000 Debt Equity Cash Flow Statement 0 0 0 0 0 Net Income Depreciation Cash Flow from Operations Capex Cash Flow from Investing Issues (Retirement) Debt Cash Flow from Financing Cash Generated (300,000) (300,000) 150,000 150,000 (150,000) Write a fomula that calculates the Net Present Value (NPV) of the cash flows in Row 61 using a 10% discount factor. Change the 'Investment Required', cell D27, to $200,000 and enter the resulting NPV value (not the formula) in the yellow box below. Keeping the $200,000 'Investment Required' change the 'Percent Debt Financed' to 0% and enter the resulting NPV value (not the formula) in the yellow box be Below we present a Excel Data Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts