Question: 21. The incremental External Rate of Return (ERR) between the Alpha and Beta backhoes (second decimal; no rounding) is a) 8.76%; b) 9.02%; c) 9.19%;

21. The incremental External Rate of Return (ERR) between the Alpha and Beta backhoes (second decimal; no rounding) is a) 8.76%; b) 9.02%; c) 9.19%; d) 9.40%.

22. The incremental External Rate of Return (ERR) between the Beta and Gamma backhoes (second decimal; no rounding) is a) 9.95%; b) 10.38%; c) 10.76%; d) 10.89%.

23. Is Beta an acceptable backhoe based on the discounted payback method? a) Yes; b) No; c) Impossible to determine its acceptance from the cash flow information provided.

24. The best backhoe based on the Discounted Payback Method is a) Alpha; b) Beta; c) Gamma; d) None of the backhoes is acceptable.

25. Must the Present Worth and Discounted Payback methods come to the same conclusion as to the acceptance of a backhoe? a) Yes; b) No

25. Must the Present Worth and Discounted Payback methods come to the same conclusion as to the acceptance of a backhoe? a) Yes; b) No

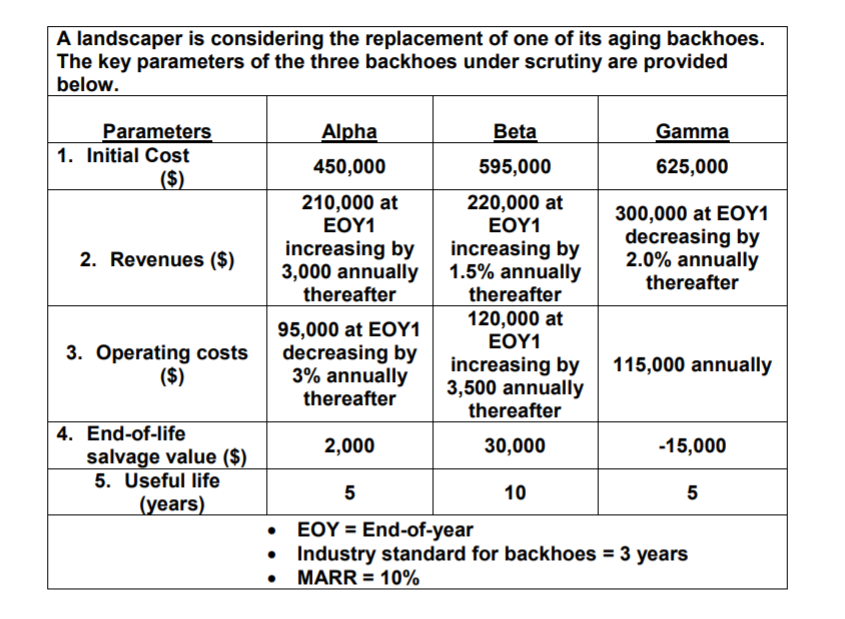

A landscaper is considering the replacement of one of its aging backhoes. The key parameters of the three backhoes under scrutiny are provided below. Parameters llohka 450,000 210,000 at EOY1 Gamma 1. Initial Cost 595,000 625,000 300,000 at EOY1 decreasing by 2.0% annually thereafter EOY1 increasing by increasing by 3,000 annually 1.5% annually 2. Revenues ($) thereafter thereafter 95,000 at EOY1 120,000 at EOY1 decreasing by thereafter 2,000 5 3. Operating costsd 3% annually | 3,500 annually increasing by 115,000 annually thereafter 30,000 10 4. End-of-life -15,000 salvage value (S) 5. Useful life yeseares) .EOY End-of-year Industry standard for backhoes 3 years MARR-10% A landscaper is considering the replacement of one of its aging backhoes. The key parameters of the three backhoes under scrutiny are provided below. Parameters llohka 450,000 210,000 at EOY1 Gamma 1. Initial Cost 595,000 625,000 300,000 at EOY1 decreasing by 2.0% annually thereafter EOY1 increasing by increasing by 3,000 annually 1.5% annually 2. Revenues ($) thereafter thereafter 95,000 at EOY1 120,000 at EOY1 decreasing by thereafter 2,000 5 3. Operating costsd 3% annually | 3,500 annually increasing by 115,000 annually thereafter 30,000 10 4. End-of-life -15,000 salvage value (S) 5. Useful life yeseares) .EOY End-of-year Industry standard for backhoes 3 years MARR-10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts