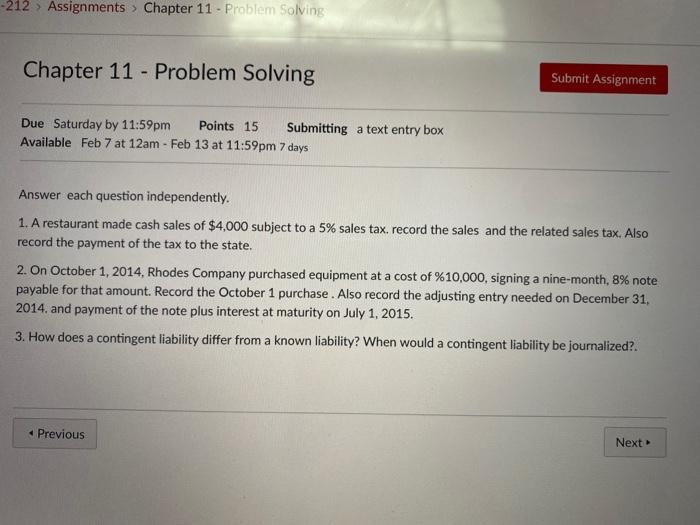

Question: -212 > Assignments > Chapter 11 - Problem Solving Chapter 11 - Problem Solving Submit Assignment Due Saturday by 11:59pm Points 15 Submitting a text

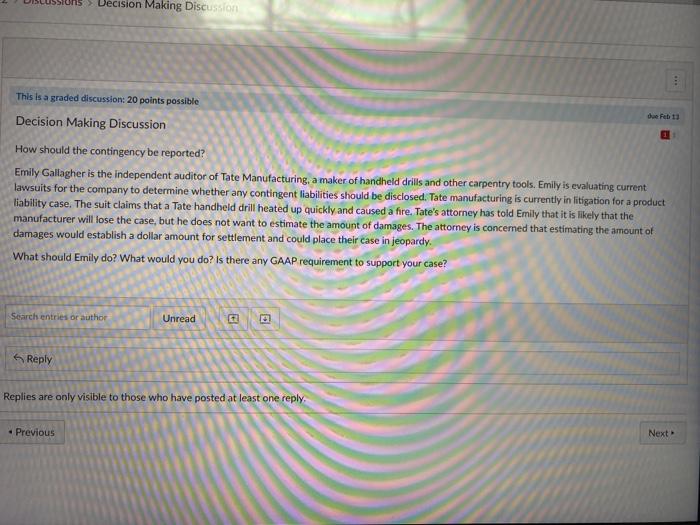

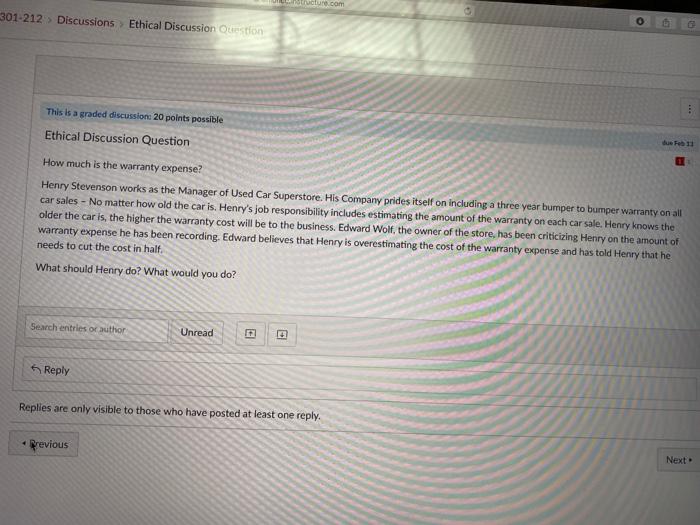

-212 > Assignments > Chapter 11 - Problem Solving Chapter 11 - Problem Solving Submit Assignment Due Saturday by 11:59pm Points 15 Submitting a text entry box Available Feb 7 at 12am - Feb 13 at 11:59pm 7 days Answer each question independently. 1. A restaurant made cash sales of $4,000 subject to a 5% sales tax record the sales and the related sales tax. Also record the payment of the tax to the state. 2. On October 1, 2014, Rhodes Company purchased equipment at a cost of %10,000, signing a nine-month, 8% note payable for that amount. Record the October 1 purchase. Also record the adjusting entry needed on December 31. 2014, and payment of the note plus interest at maturity on July 1, 2015. 3. How does a contingent liability differ from a known liability? When would a contingent liability be journalized?. Previous Next in > Decision Making Discussion This is a graded discussion: 20 points possible de 12 Decision Making Discussion How should the contingency be reported? Emily Gallagher is the independent auditor of Tate Manufacturing, a maker of handheld drills and other carpentry tools. Emily is evaluating current lawsuits for the company to determine whether any contingent liabilities should be disclosed. Tate manufacturing is currently in litigation for a product liability case. The suit claims that a Tate handheld drill heated up quickly and caused a fire. Tate's attorney has told Emily that it is likely that the manufacturer will lose the case, but he does not want to estimate the amount of damages. The attorney is concemed that estimating the amou damages would establish a dollar amount for settlement and could place their case in jeopardy. What should Emily do? What would you do? Is there any GAAP requirement to support your case? of Search entries or author Unread 3 BO Reply Replies are only visible to those who have posted at least one reply Previous Next dun.com 301-212 - Discussions Ethical Discussion Question This is a graded discussion 20 points possible de Feb 11 Ethical Discussion Question How much is the warranty expense? Henry Stevenson works as the Manager of Used Car Superstore. His Company prides itself on including a three year bumper to bumper warranty on all car sales - No matter how old the car is. Henry's job responsibility includes estimating the amount of the warranty on each car sale. Henry knows the older the car is, the higher the warranty cost will be to the business. Edward Wolf, the owner of the store, has been criticizing Henry on the amount of warranty expense he has been recording. Edward believes that Henry is overestimating the cost of the warranty expense and has told Henry that he needs to cut the cost in half What should Henry do? What would you do? Search entries or author Unread E Reply Replies are only visible to those who have posted at least one reply. Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts