Question: -212 > Assignments > Chapter 11 - Problem Solving Chapter 11 - Problem Solving Submit Assignment Due Saturday by 11:59pm Points 15 Submitting a text

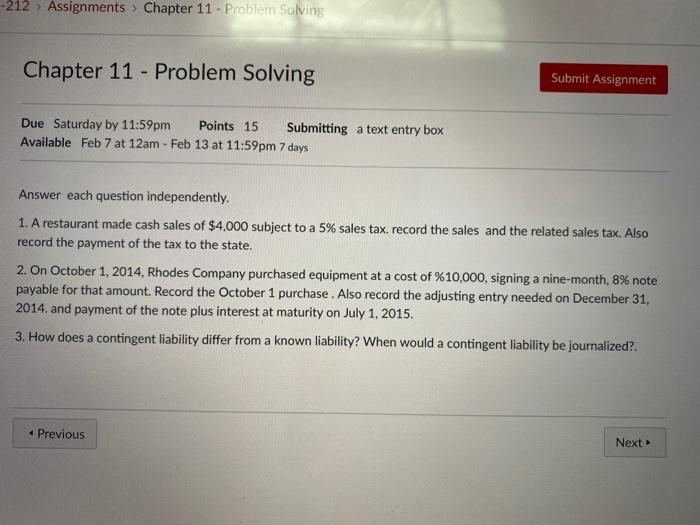

-212 > Assignments > Chapter 11 - Problem Solving Chapter 11 - Problem Solving Submit Assignment Due Saturday by 11:59pm Points 15 Submitting a text entry box Available Feb 7 at 12am - Feb 13 at 11:59pm 7 days Answer each question independently. 1. A restaurant made cash sales of $4,000 subject to a 5% sales tax record the sales and the related sales tax. Also record the payment of the tax to the state. 2. On October 1, 2014, Rhodes Company purchased equipment at a cost of %10,000, signing a nine-month, 8% note payable for that amount. Record the October 1 purchase. Also record the adjusting entry needed on December 31. 2014, and payment of the note plus interest at maturity on July 1, 2015. 3. How does a contingent liability differ from a known liability? When would a contingent liability be journalized?. Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts