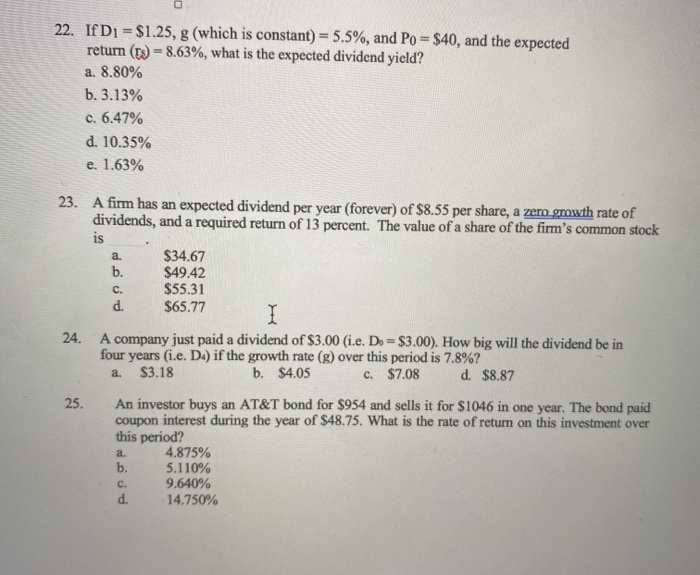

Question: 22. If D1 = $1.25, g (which is constant) = 5.5%, and Po = $40, and the expected return (t) = 8.63%, what is the

22. If D1 = $1.25, g (which is constant) = 5.5%, and Po = $40, and the expected return (t) = 8.63%, what is the expected dividend yield? a. 8.80% b. 3.13% c. 6.47% d. 10.35% e. 1.63% a. 24. 23. A firm has an expected dividend per year (forever) of $8.55 per share, a zero growth rate of dividends, and a required return of 13 percent. The value of a share of the firm's common stock is $34.67 b. $49.42 c. $55.31 d. $65.77 I A company just paid a dividend of $3.00 (i.e. Do = $3.00). How big will the dividend be in four years (i.e. Du) if the growth rate (g) over this period is 7.8%? $3.18 b. $4.05 c. $7.08 d. $8.87 An investor buys an AT&T bond for $954 and sells it for $1046 in one year. The bond paid coupon interest during the year of $48.75. What is the rate of return on this investment over this period? 4.875% b. 5.110% 9.640% d. 14.750% a. 25. a. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts