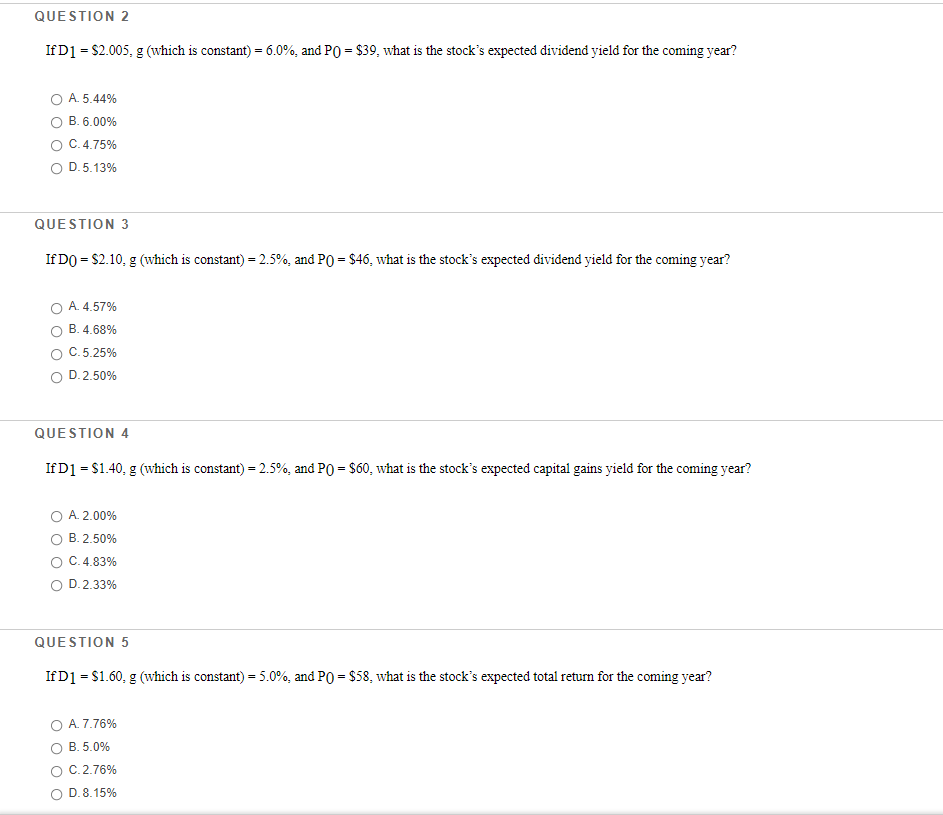

Question: QUESTION 2 If D1 = $2.005, g (which is constant) = 6.0% and PO = $39, what is the stock's expected dividend yield for the

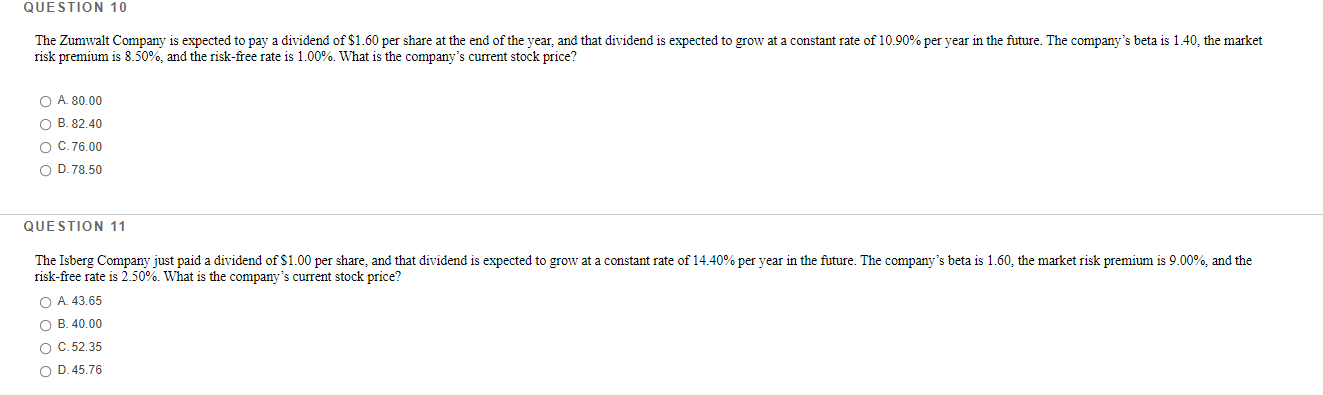

QUESTION 2 If D1 = $2.005, g (which is constant) = 6.0% and PO = $39, what is the stock's expected dividend yield for the coming year? A.5.44% B. 6.00% C. 4.75% D.5.13% QUESTION 3 If DO) = $2.10. g (which is constant) = 2.5%, and PO = $46, what is the stock's expected dividend yield for the coming year? A. 4.57% B. 4.68% C.5.25% OD.2.50% QUESTION 4 If D1 = $1.40. g (which is constant) = 2.5%, and PO = $60, what is the stock's expected capital gains yield for the coming year? A. 2.00% O B.2.50% C.4.83% OD.2.33% QUESTION 5 If D1 = $1.60. g (which is constant) = 5.0% and PO = $58, what is the stock's expected total return for the coming year? A. 7.76% B.5.0% C.2.76% D. 8.15% QUESTION 10 The Zumwalt Company is expected to pay a dividend of $1.60 per share at the end of the year, and that dividend is expected to grow at a constant rate of 10.90% per year in the future. The company's beta is 1.40, the market risk premium is 8.50%, and the risk-free rate is 1.00%. What is the company's current stock price? O A. 80.00 OB. 82.40 O C.76.00 O D. 78.50 QUESTION 11 The Isberg Company just paid a dividend of $1.00 per share, and that dividend is expected to grow at a constant rate of 14.40% per year in the future. The company's beta is 1.60, the market risk premium is 9.00%, and the risk-free rate is 2.50%. What is the company's current stock price? O A. 43.65 O B. 40.00 O C.52.35 O D.45.76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts