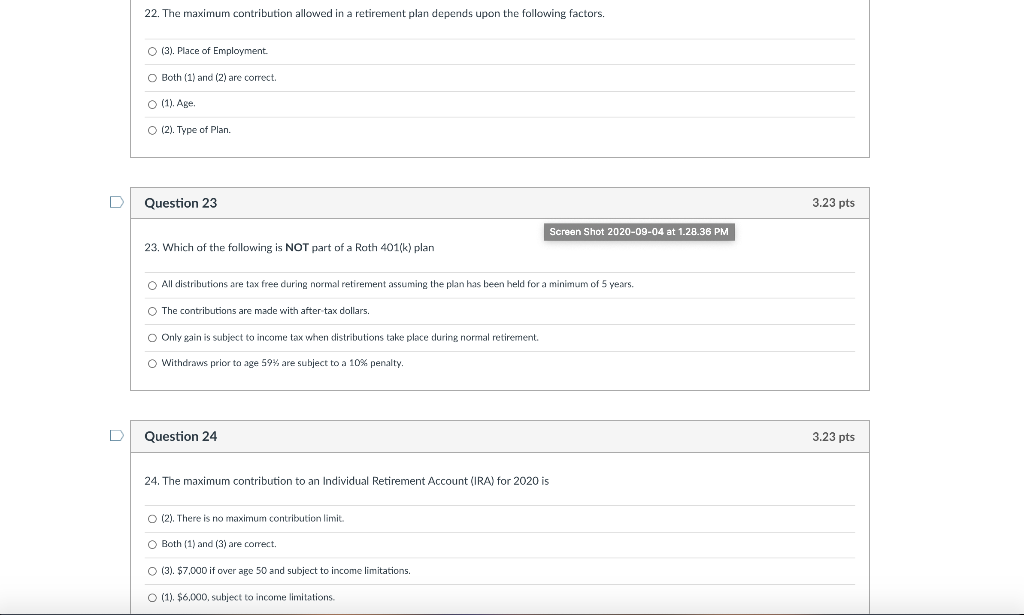

Question: 22. The maximum contribution allowed in a retirement plan depends upon the following factors. O (3). Place of Employment. O Both (1) and (2) are

22. The maximum contribution allowed in a retirement plan depends upon the following factors. O (3). Place of Employment. O Both (1) and (2) are correct. (1). Age (2). Type of Plan. D Question 23 3.23 pts Screen Shot 2020-09-04 at 1.28.36 PM 23. Which of the following is NOT part of a Roth 401(k) plan All distributions are tax free during normal retirement assuming the plan has been held for a minimum of 5 years. The contributions are made with after tax dollars. Only gain is subject to income tax when distributions take place during normal retirement. O Withdraws prior to age 59% are subject to a 10% penalty Question 24 3.23 pts 24. The maximum contribution to an Individual Retirement Account (IRA) for 2020 is (2). There is no maximum contribution limit. Both (1) and (3) are correct. O (3). $7.000 if over age 50 and subject to income limitations. O (1), $6,000, subject to income limitations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts