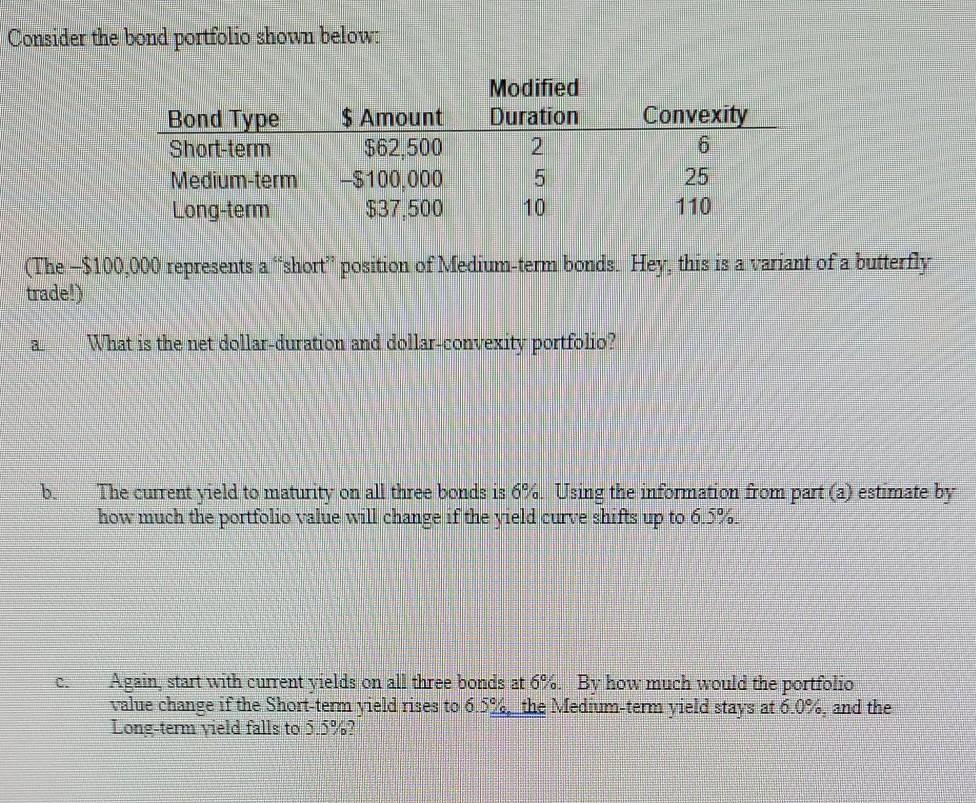

Question: Consider the bond portfolio shown below: Bond Type Short-term Medium-term Long-term $ Amount $62,500 -$100,000 $37.500 Modified Duration 2 5 10 Convexity 6 25 110

Consider the bond portfolio shown below: Bond Type Short-term Medium-term Long-term $ Amount $62,500 -$100,000 $37.500 Modified Duration 2 5 10 Convexity 6 25 110 (The -$100.000 represents a short position of Medium-term bonds. Hey, this is a variant of a butterfly trade. What is the net dollar-duration and dollar-convexity portfolio? The current yield to matunity on all three bonds is 6%. Using the information from part (a) estimate by how much the portfolio value will change of the yield curve shifts up to 6.5%. Again start with current yields on all three bonds at 6%. By how much would the portfolio value change if the Short-term yield rises to 6.5% the Medium-term yield stays at 6.0%, and the Long-term vield falls to 5.5967 Consider the bond portfolio shown below: Bond Type Short-term Medium-term Long-term $ Amount $62,500 -$100,000 $37.500 Modified Duration 2 5 10 Convexity 6 25 110 (The -$100.000 represents a short position of Medium-term bonds. Hey, this is a variant of a butterfly trade. What is the net dollar-duration and dollar-convexity portfolio? The current yield to matunity on all three bonds is 6%. Using the information from part (a) estimate by how much the portfolio value will change of the yield curve shifts up to 6.5%. Again start with current yields on all three bonds at 6%. By how much would the portfolio value change if the Short-term yield rises to 6.5% the Medium-term yield stays at 6.0%, and the Long-term vield falls to 5.5967

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts