Question: 23. ( 25 points total) There are only two assets in the world. Stocks have an expected return of 10% and standard deviation of 30%;

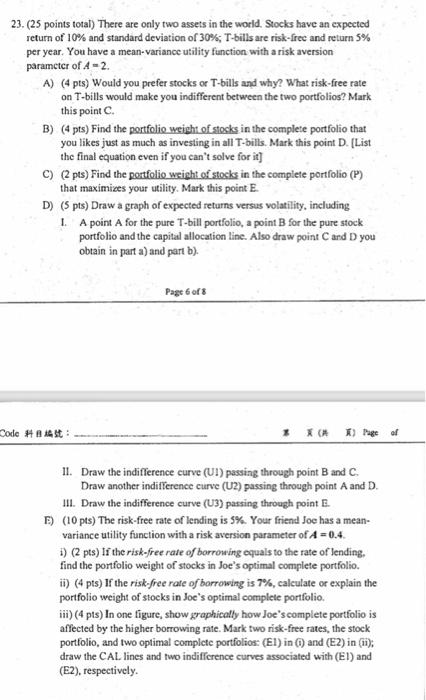

23. ( 25 points total) There are only two assets in the world. Stocks have an expected return of 10% and standard deviation of 30%; T-bills are risk-frec and return 5% per year. You have a mean-variance utility function with a risk aversion parameter of A=2. A) (4 pts) Would you prefer stocks or T-bills and why? What risk-free rate on T-bills would make you indifferent between the two portfolios? Mark this point C. B) (4 pts) Find the portfolio weight of stocks in the complete portfolio that you likes just as much as investing in all T-bills. Mark this point D. [List the final equation even if you can't solve for it] C) (2pts) Find the portfolio weicht of stocks in the complete portfolio (P) that maximizes your utility. Mark this point E. D) (5 pts) Draw a graph of expected returns versus volatility, including I. A point A for the pure T-bill portfolio, a point B for the pure stock portfolio and the capital allocation line. Also draw point C and D you obtain in part a) and part b). Page 6 of 8 II. Draw the indifference curve (U1) passing through point B and C. Draw another indiflerence curve (U2) passing through point A and D. III. Draw the indifference curve (U3) parsing through point E. B) (10 pts) The risk-free rate of lending is 5%. Your friend Joe has a meanvariance utility function with a risk aversion parameter of A=0.4. i) (2 pts) If the risk-free rate of borrowing equals to the rate of lending, find the porffolio weight of stocks in Joe's optimal complete portfolio. ii) (4pts) If the risk-free rate of borrowing is 7%, calculate or explain the portfolio weight of stocks in Joe's optimal complete portfolio. iii) (4 pts) In one figure, show graphically how Joe's complete portfolio is affected by the higher borrowing rate. Mark two risk-free rates, the stock portfolio, and two optimal complete portfolios: (E1) in (1) and (E2) in (ii); draw the CAL. lines and two indifference curves associated with (EI) and (E2), respectively. 23. ( 25 points total) There are only two assets in the world. Stocks have an expected return of 10% and standard deviation of 30%; T-bills are risk-frec and return 5% per year. You have a mean-variance utility function with a risk aversion parameter of A=2. A) (4 pts) Would you prefer stocks or T-bills and why? What risk-free rate on T-bills would make you indifferent between the two portfolios? Mark this point C. B) (4 pts) Find the portfolio weight of stocks in the complete portfolio that you likes just as much as investing in all T-bills. Mark this point D. [List the final equation even if you can't solve for it] C) (2pts) Find the portfolio weicht of stocks in the complete portfolio (P) that maximizes your utility. Mark this point E. D) (5 pts) Draw a graph of expected returns versus volatility, including I. A point A for the pure T-bill portfolio, a point B for the pure stock portfolio and the capital allocation line. Also draw point C and D you obtain in part a) and part b). Page 6 of 8 II. Draw the indifference curve (U1) passing through point B and C. Draw another indiflerence curve (U2) passing through point A and D. III. Draw the indifference curve (U3) parsing through point E. B) (10 pts) The risk-free rate of lending is 5%. Your friend Joe has a meanvariance utility function with a risk aversion parameter of A=0.4. i) (2 pts) If the risk-free rate of borrowing equals to the rate of lending, find the porffolio weight of stocks in Joe's optimal complete portfolio. ii) (4pts) If the risk-free rate of borrowing is 7%, calculate or explain the portfolio weight of stocks in Joe's optimal complete portfolio. iii) (4 pts) In one figure, show graphically how Joe's complete portfolio is affected by the higher borrowing rate. Mark two risk-free rates, the stock portfolio, and two optimal complete portfolios: (E1) in (1) and (E2) in (ii); draw the CAL. lines and two indifference curves associated with (EI) and (E2), respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts