Question: 23. Below shows the balance sheet, cash flow statement, and income statement of Uber Technologies, Inc. (ticker: UBER) in 2020 and 2021. (a) Calculate accounts

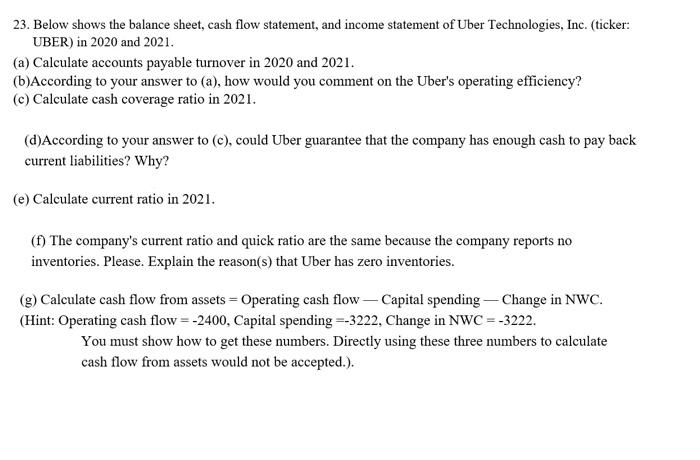

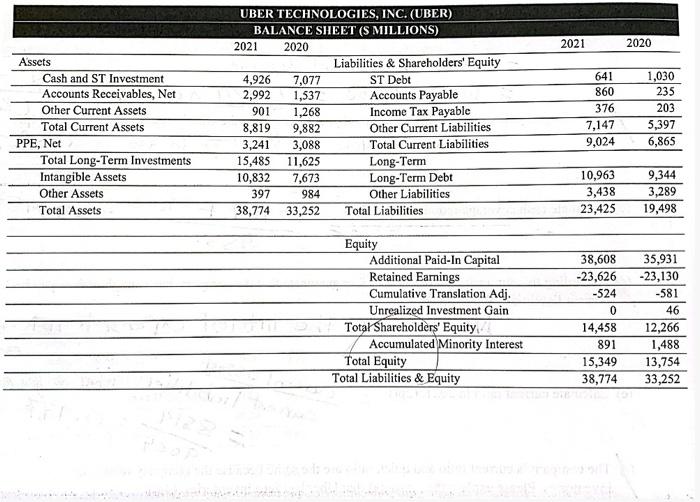

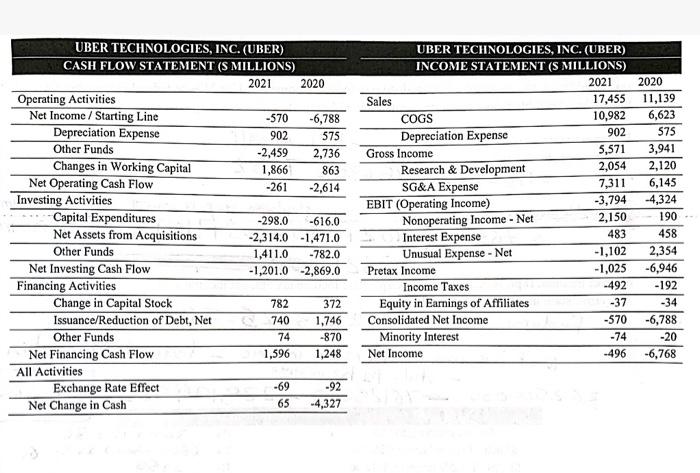

23. Below shows the balance sheet, cash flow statement, and income statement of Uber Technologies, Inc. (ticker: UBER) in 2020 and 2021. (a) Calculate accounts payable turnover in 2020 and 2021. (b)According to your answer to (a), how would you comment on the Uber's operating efficiency? (c) Calculate cash coverage ratio in 2021 . (d)According to your answer to (c), could Uber guarantee that the company has enough cash to pay back current liabilities? Why? (e) Calculate current ratio in 2021 . (f) The company's current ratio and quick ratio are the same because the company reports no inventories. Please. Explain the reason(s) that Uber has zero inventories. (g) Calculate cash flow from assets = Operating cash flow - Capital spending - Change in NWC. (Hint: Operating cash flow =2400, Capital spending =3222, Change in NWC =3222. You must show how to get these numbers. Directly using these three numbers to calculate cash flow from assets would not be accepted.). UBER TECHNOLOGIES, INC. (UBER) BALANCE SHEET (S MILLIONS) Equity All Activities \begin{tabular}{crr} \hline Exchange Rate Effect & 69 & 92 \\ \hline Net Change in Cash & 65 & 4,327 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts