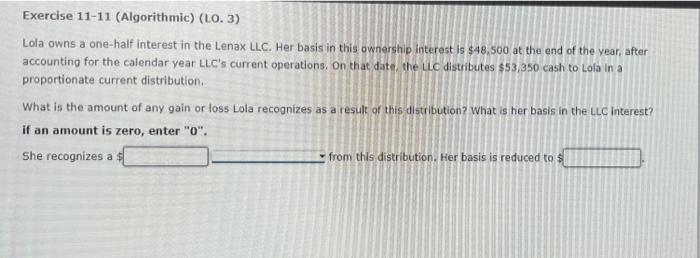

Question: 23- Exercise 11-11 (Algorithmic) (LO. 3) Lola owns a one-half interest in the Lenax LLC. Her basis in this ownership interest is $48,500 at the

Exercise 11-11 (Algorithmic) (LO. 3) Lola owns a one-half interest in the Lenax LLC. Her basis in this ownership interest is $48,500 at the end of the year, after accounting for the calendar year LLC's current operations. On that date, the LLC distributes $53,350 cash to Lola in a proportionate current distribution. What is the amount of any gain or loss Lola recognizes as a result of this distribution? What is her basis in the LLC interest? if an amount is zero, enter "O". She recognizes a si from this distribution. Her basis is reduced to $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts