Question: (25 points total) In the Excel file that is linked to this question, you will see the stock prices for 2 different stocks. a) (5

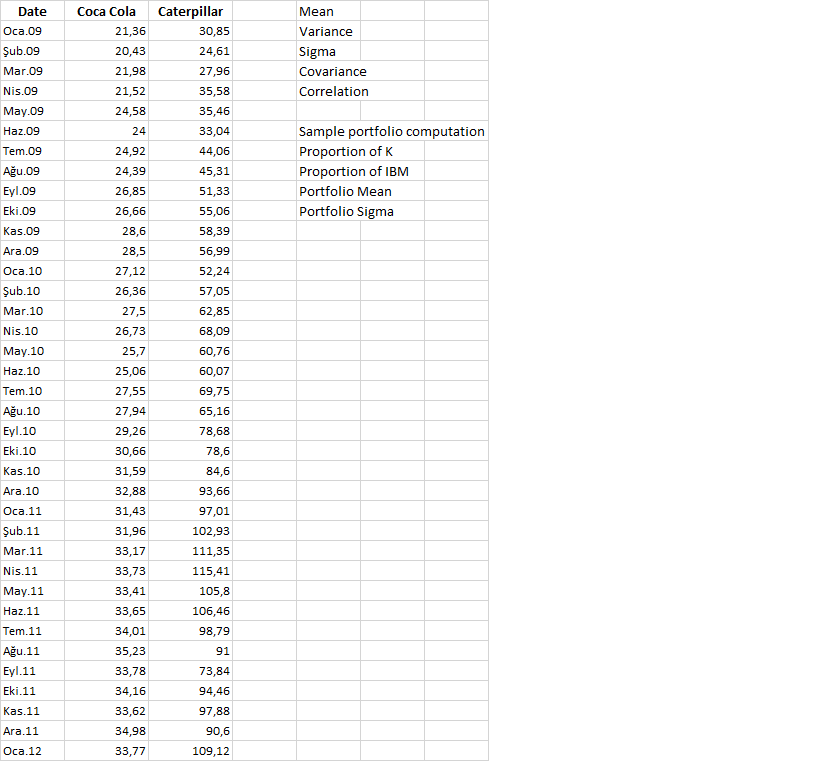

(25 points total) In the Excel file that is linked to this question, you will see the stock prices for 2 different stocks.

a) (5 points) Please calculate the Mean, Variance, Standard Deviation, Covariance and Correlation for your two stock returns.

b) (5 points) Assume that you have a hypothetical portfolio of 30% (stock 1) and 70% (stock 2 ). Calculate the portfolio mean return and standard deviation of this portfolio.

c) (5 points) Vary the proportions of your stock 1 between -1 and +1 (increments of 0.1) and create a data table for portfolio means and standard deviations for the different weights used

d) (5 points) Draw a graph of portfolio standard deviations and mean returns using the different values you found in the data table.

e) (5 points) Describe/Explain what the graph shows us with your own words

Date Oca.09 Sub.09 Mar.09 Nis.09 May.09 Haz.09 Coca Cola 21,36 20,43 21,98 21,52 Mean Variance Sigma Covariance Correlation 24,58 24 24,92 24,39 Tem.09 Au.09 Eyl.09 Eki.09 Caterpillar 30,85 24,61 27,96 35,58 35,46 33,04 44,06 45,31 51,33 55,06 58,39 56,99 52,24 57,05 62,85 68,09 60,76 60,07 69,75 65,16 78,68 Sample portfolio computation Proportion of K Proportion of IBM Portfolio Mean Portfolio Sigma Kas.09 Ara.09 Oca. 10 ub.10 Mar.10 Nis. 10 May.10 Haz.10 Tem. 10 Au.10 Eyl.10 Eki.10 78,6 Kas.10 26,85 26,66 28,6 28,5 27,12 26,36 27,5 26,73 25,7 25,06 27,55 27,94 29,26 30,66 31,59 32,88 31,43 31,96 33,17 33,73 33,41 33,65 34,01 35,23 33,78 34,16 33,62 34,98 33,77 Ara.10 Oca. 11 ub.11 Mar.11 Nis 11 May 11 Haz.11 Tem. 11 Au.11 Eyl.11 Eki 11 84,6 93,66 97,01 102,93 111,35 115,41 105,8 106,46 98,79 91 73,84 94,46 97,88 90,6 Kas.11 Ara.11 Oca. 12 109,12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts