Question: (25 pts) A project has a NPV, assuming a11 equity financing, of $1.5 mi11ion. To finance the project, debt is issued with associated flotation costs

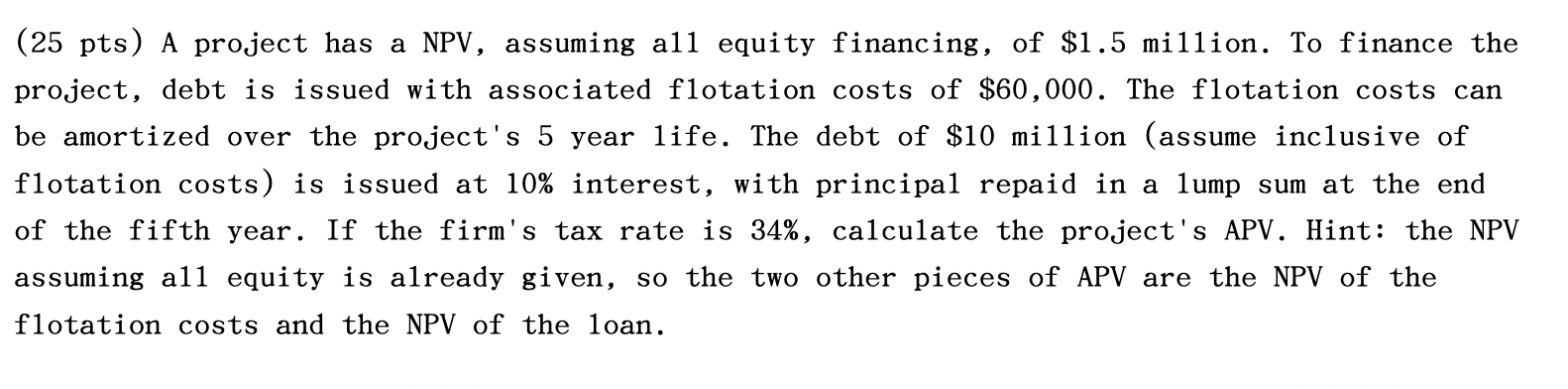

(25 pts) A project has a NPV, assuming a11 equity financing, of $1.5 mi11ion. To finance the project, debt is issued with associated flotation costs of $60,000. The flotation costs can be amortized over the project's 5 year 1 ife. The debt of $10 mi11ion (assume inclusive of flotation costs) is issued at 10% interest, with principa1 repaid in a 1 ump sum at the end of the fifth year. If the firm's tax rate is 34%, calculate the project's APV. Hint: the NPV assuming a11 equity is already given, so the two other pieces of APV are the NPV of the flotation costs and the NPV of the loan

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock