Question: q5 A project has a NPV, azuming all equity financing, of $1.5 million. To finance the project, debt is issued with associated flotation costs of

q5

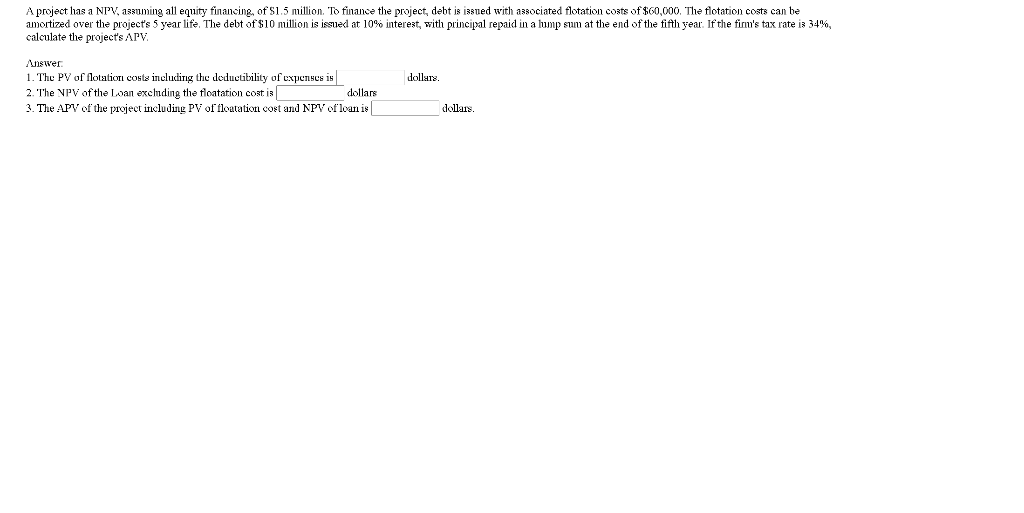

A project has a NPV, azuming all equity financing, of $1.5 million. To finance the project, debt is issued with associated flotation costs of $60,000. The flotation costs can be amortized over the project's 5 year life. The debt of $10 million is issued at 10% interest, with principal repaid in a hump sum at the end of the fifth year. If the firm's tax rate iz 34%, calculate the project's Arv Answer 1. The PV of flotation costs including the deductibility of expenses is dollars 2. The NPV of the Loan excluding the floatation cost is dollars 3. The APV of the project including PV of floatation cost and NPV of loan is dollars A project has a NPV, azuming all equity financing, of $1.5 million. To finance the project, debt is issued with associated flotation costs of $60,000. The flotation costs can be amortized over the project's 5 year life. The debt of $10 million is issued at 10% interest, with principal repaid in a hump sum at the end of the fifth year. If the firm's tax rate iz 34%, calculate the project's Arv Answer 1. The PV of flotation costs including the deductibility of expenses is dollars 2. The NPV of the Loan excluding the floatation cost is dollars 3. The APV of the project including PV of floatation cost and NPV of loan is dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts