Question: Your company, CSUS Inc., is considering a new project whose data are shown below. The required equipment has a 3-year tax life, and the accelerated

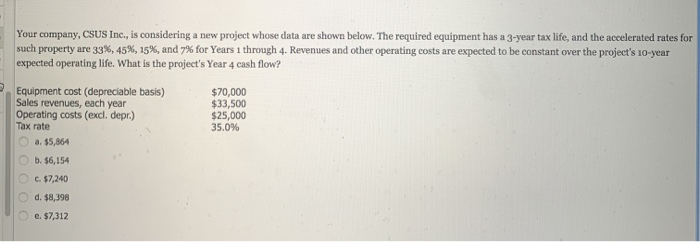

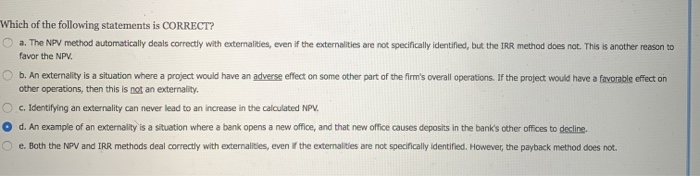

Your company, CSUS Inc., is considering a new project whose data are shown below. The required equipment has a 3-year tax life, and the accelerated rates for such property are 33%, 45%, 15%, and 7% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life. What is the project's Year 4 cash flow? $70,000 $33,500 $25,000 35.0% Equipment cost (depreciable basis) Sales revenues, each year Operating costs (excl. depr.) Tax rate a. $5,864 b. $6,154 c. $7,240 d. $8,398 e. $7,312 "Which of the following statements is CORRECT? a. The NPV method automatically deals correctly with externalities, even if the externalities are not specifically identified, but the IRR method does not. This is another reason to favor the NPV. O b. An externality is a situation where a project would have an adverse effect on some other part of the firm's overall operations. If the project would have a favorable effect on other operations, then this is not an externality, O c. Identifying an externality can never lead to an increase in the calculated NPV. O d. An example of an externality is a situation where a bank opens a new office, and that new office causes deposits in the bank's other offices to decline. e. Both the NPV and IRR methods deal correctly with externalities, even if the externalities are not specifically identified. However, the payback method does not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts