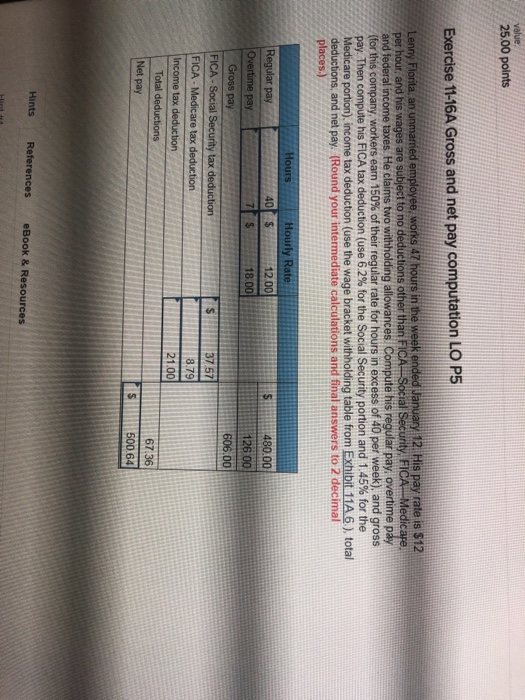

Question: 25.00 points Exercise 11-16A Gross and net pay computation LO P5 e pay k), and gross workers earn 150% of their regular pay Then compute

25.00 points Exercise 11-16A Gross and net pay computation LO P5 e pay k), and gross workers earn 150% of their regular pay Then compute his FICA tax deduction (use 62% for the Social Security portion and 1.45% for the edicare portion), income tax deduction (use the wage bracket withholding table from Exhibit 11A 6.), total deductions, and net pay. (Round your intermediate calculations and final answers to 2 decimal $480.00 126 00 606.00 12.00 pay 18.00 FICA-Medicare tax deduction 8.79 21.00 67.36 500 64 Hints ReferenceseBook & Resources 25.00 points Exercise 11-16A Gross and net pay computation LO P5 e pay k), and gross workers earn 150% of their regular pay Then compute his FICA tax deduction (use 62% for the Social Security portion and 1.45% for the edicare portion), income tax deduction (use the wage bracket withholding table from Exhibit 11A 6.), total deductions, and net pay. (Round your intermediate calculations and final answers to 2 decimal $480.00 126 00 606.00 12.00 pay 18.00 FICA-Medicare tax deduction 8.79 21.00 67.36 500 64 Hints ReferenceseBook & Resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts