Question: 26. What are the important foot method 27. Explain the fisher effects of inflation on rates of retune with the suitable example. 28. Write all

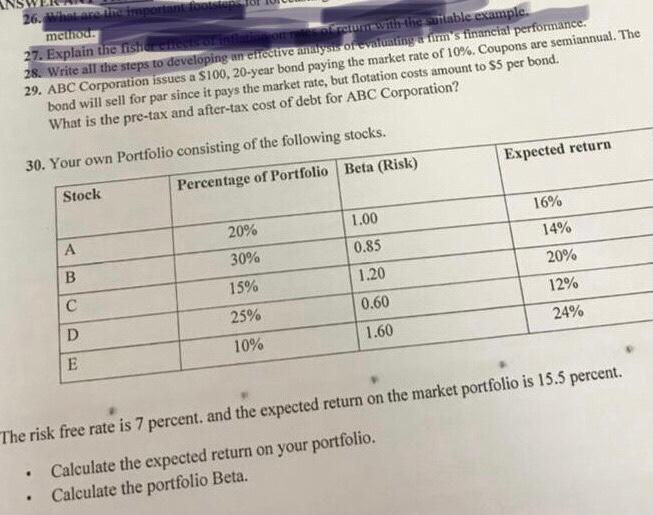

26. What are the important foot method 27. Explain the fisher effects of inflation on rates of retune with the suitable example. 28. Write all the steps to developing an effective analysis of evaluating a firm's financial performance. 29. ABC Corporation issues a $100, 20-year bond paying the market rate of 10%. Coupons are semiannual. The bond will sell for par since it pays the market rate, but flotation costs amount to $5 per bond. What is the pre-tax and after-tax cost of debt for ABC Corporation? 30. Your own Portfolio consisting of the following stocks. Stock Percentage of Portfolio Beta (Risk) Expected return A 20% 1.00 16% 30% B 14% 0.85 1.20 15% 20% C 25% D 12% 0.60 10% E 24% 1.60 The risk free rate is 7 percent. and the expected return on the market portfolio is 15.5 percent. Calculate the expected return on your portfolio. Calculate the portfolio Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts