Question: 26 Which statement is most correct regarding capital structure? (2 Points) According to the Pecking-Order Model, because of asymmetric information, the announcement of an equity

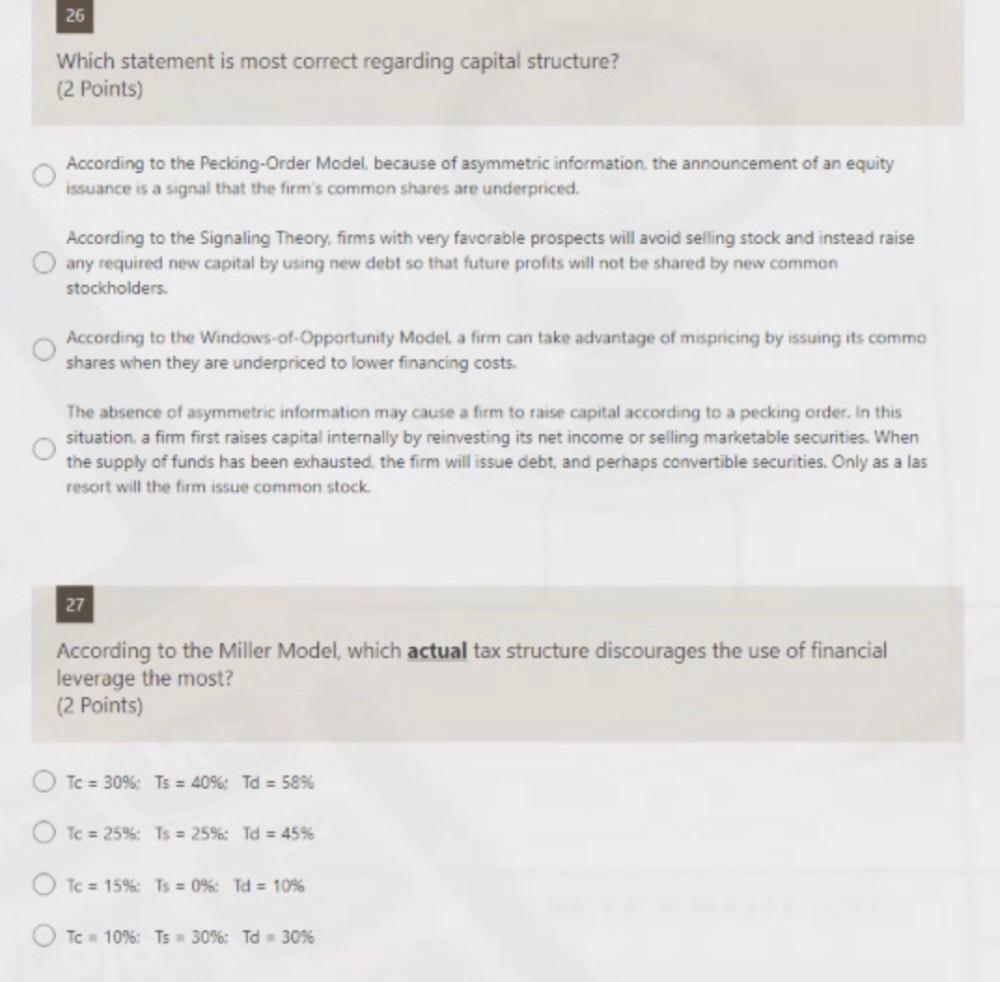

26 Which statement is most correct regarding capital structure? (2 Points) According to the Pecking-Order Model, because of asymmetric information, the announcement of an equity issuance is a signal that the firm's common shares are underpriced. According to the Signaling Theory, firms with very favorable prospects will avoid selling stock and instead raise any required new capital by using new debt so that future profits will not be shared by new common stockholders. According to the Windows-of-Opportunity Model, a firm can take advantage of mispricing by issuing its commo shares when they are underpriced to lower financing costs. The absence of asymmetric information may cause a firm to raise capital according to a pecking order. In this situation, a firm first raises capital internally by reinvesting its net income or selling marketable securities. When the supply of funds has been exhausted, the firm will issue debt, and per convertible securities. Only as a las resort will the firm issue common stock. 27 According to the Miller Model, which actual tax structure discourages the use of financial leverage the most? (2 Points) Tc = 30%: Ts = 40%: Td = 58% Tc = 25%: Ts = 25%; Td = 45% Tc 15% : Ts = 0%: Td = 10% Tc 10%: Ts 30%: Td 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts