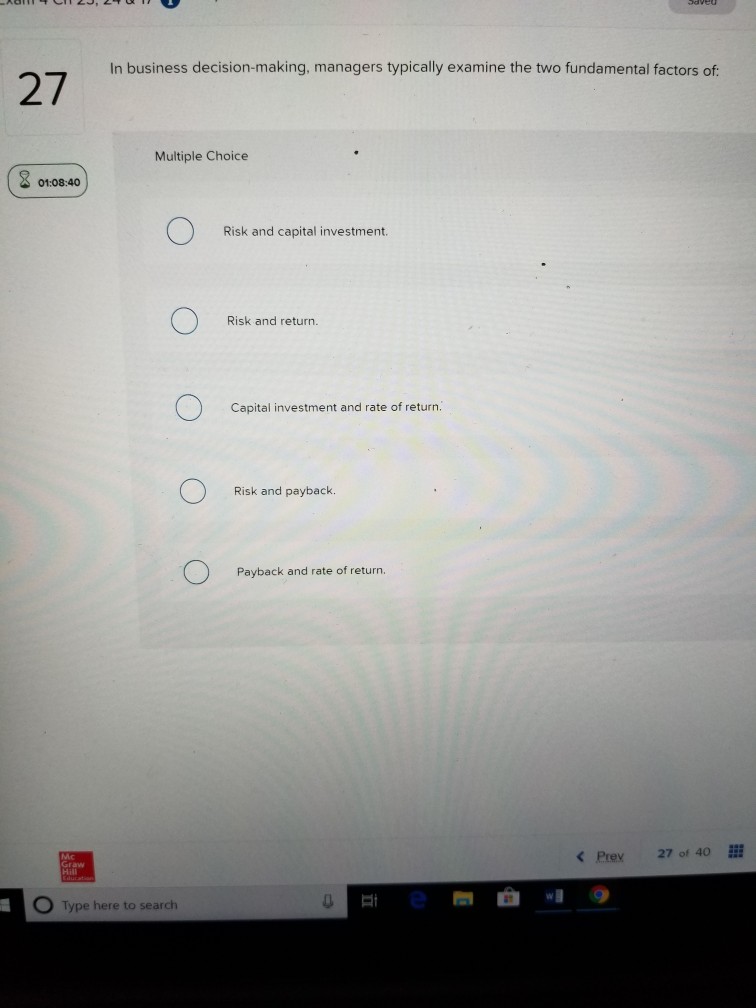

Question: 27 01:08:40 In business decision-making, managers typically examine the two fundamental factors of: Multiple Choice Grow Hill Edurata Type here to search O Risk

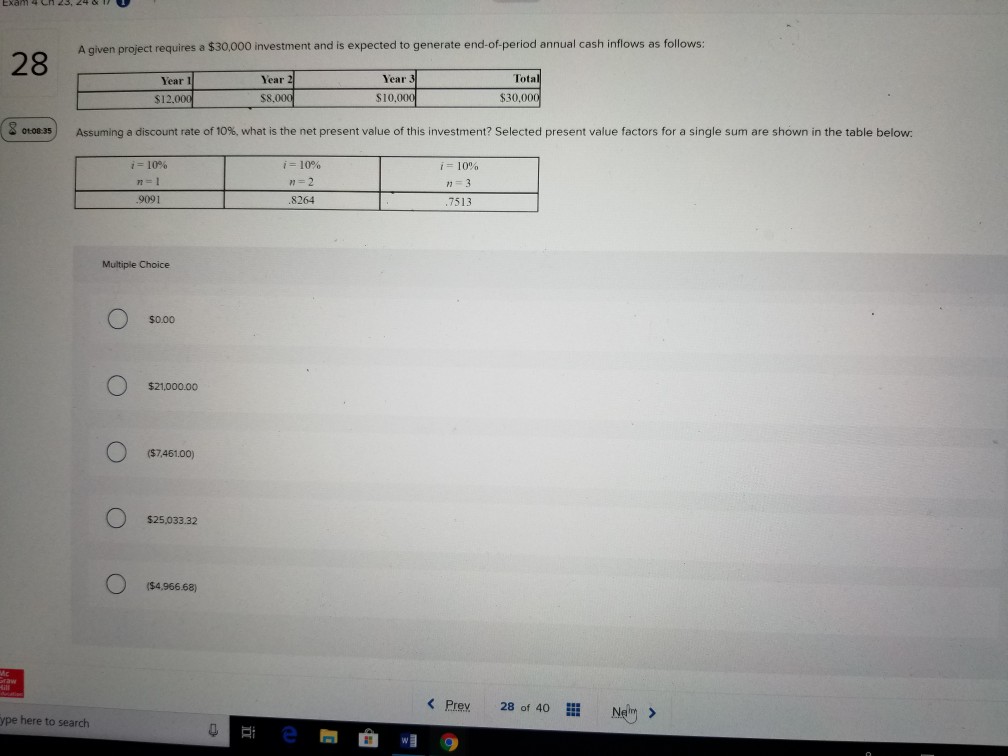

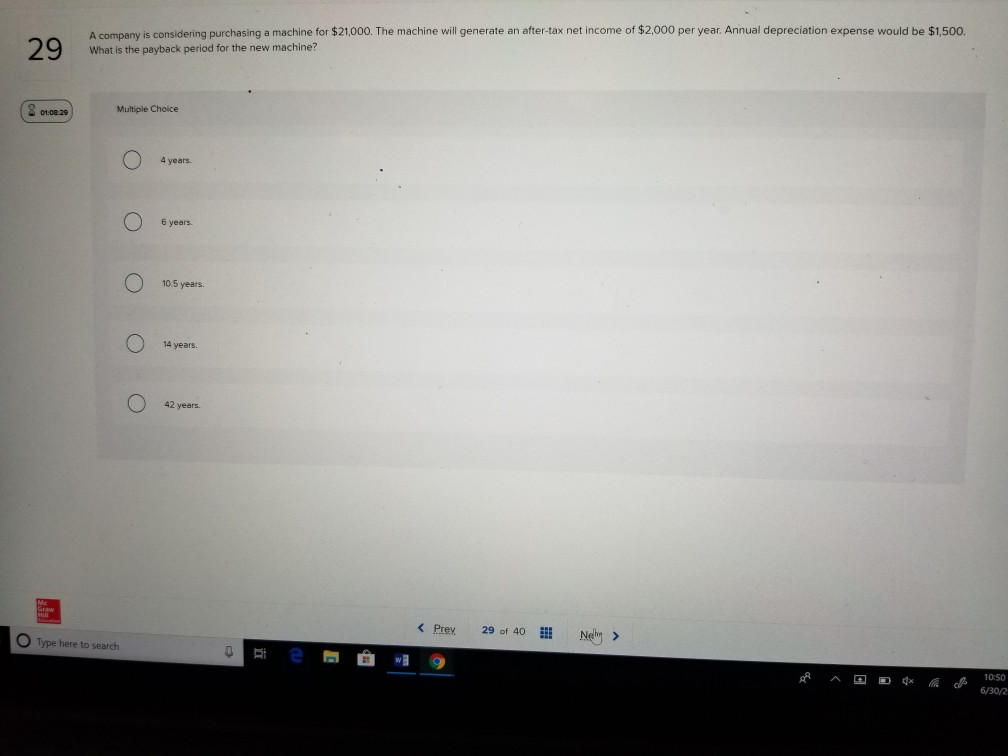

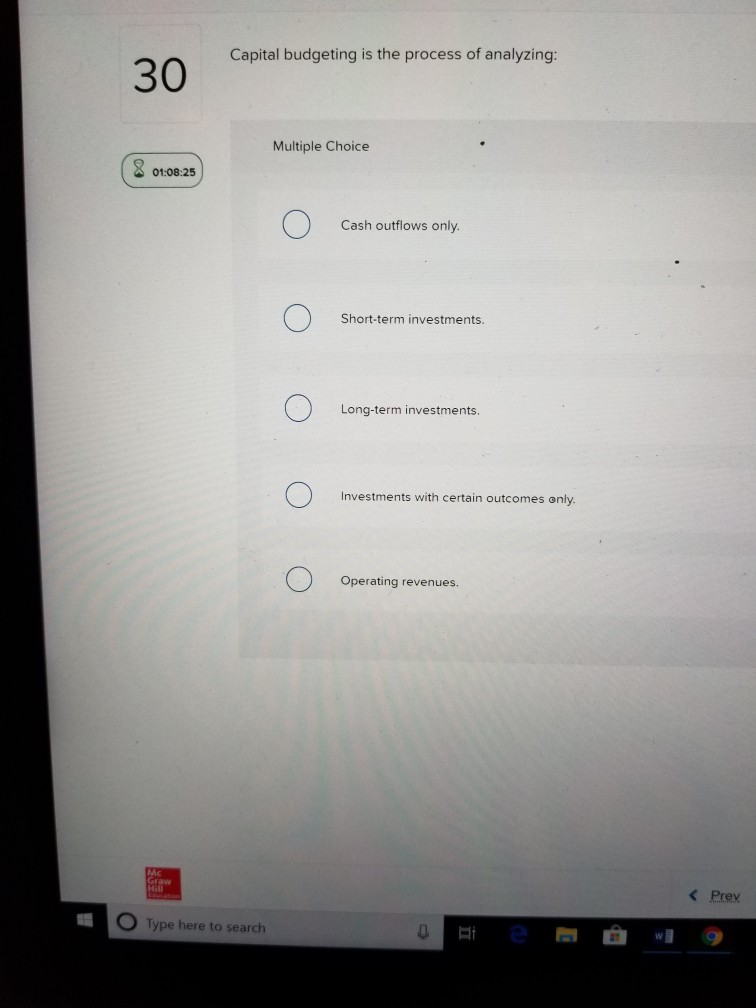

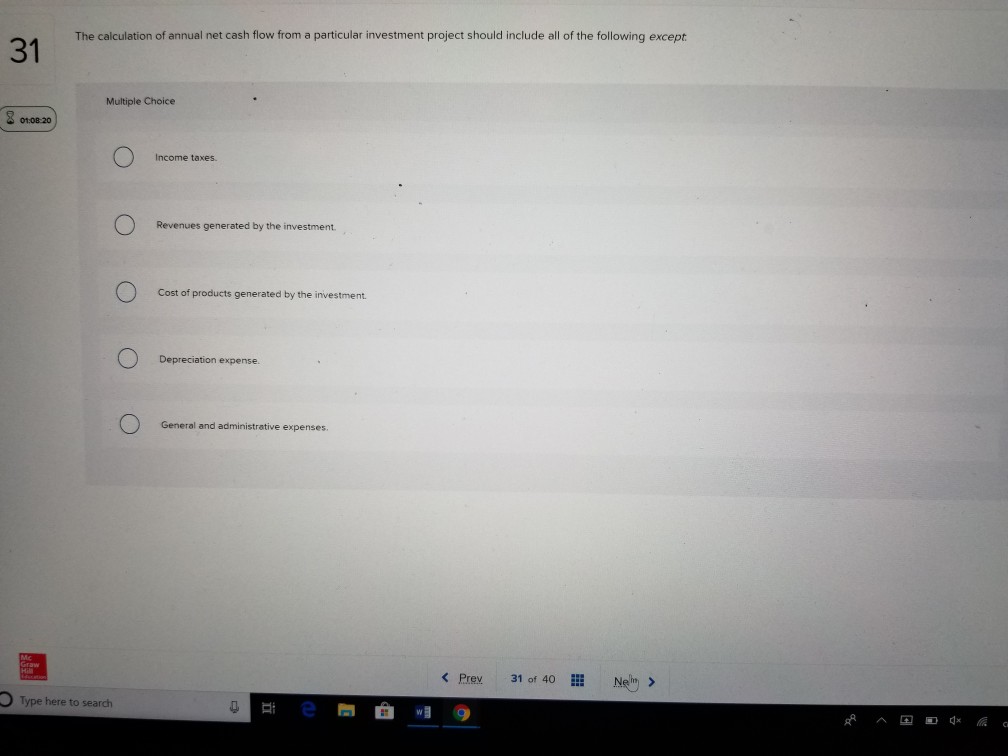

27 01:08:40 In business decision-making, managers typically examine the two fundamental factors of: Multiple Choice Grow Hill Edurata Type here to search O Risk and capital investment. Risk and return. Capital investment and rate of return. Risk and payback. Payback and rate of return. 0 < Prev 27 of 40 28 8 01:08:35 Mc Graw A given project requires a $30,000 investment and is expected to generate end-of-period annual cash inflows as follows: Year 1 $12,000 Year 2 $8,000 Year 3 $10,000 Assuming a discount rate of 10%, what is the net present value of this investment? Selected present value factors for a single sum are shown in the table below: ype here to search i= 10 % n=1 .9091 Multiple Choice O $0.00 O $21,000.00 ($7,461.00) O $25,033.32 O ($4,966.68) 0 H i = 10% n = 2 .8264 er Total $30,000 i = 10% n = 3 .7513 < Prev 28 of 40 Nem > 29 A company is considering purchasing a machine for $21,000. The machine will generate an after-tax net income of $2,000 per year. Annual depreciation expense would be $1,500. What is the payback period for the new machine? 8 01:08:29 Mc Graw Multiple Choice Type here to search O O O O O 4 years. 6 years. 10.5 years. 14 years. 42 years. 0 < Prev 29 of 40 Nehy > 4x C 10:50 6/30/2 30 01:08:25 Mc Graw 19009 Capital budgeting is the process of analyzing: Type here to search Multiple Choice Cash outflows only. Short-term investments. Long-term investments. Investments with certain outcomes only. Operating revenues. 1 1 < Prev 31 01.08.20 Graw The calculation of annual net cash flow from a particular investment project should include all of the following except. Multiple Choice Type here to search O Income taxes. Revenues generated by the investment. Cost products generated by the investment. Depreciation expense. General and administrative expenses. 0 1 W < Prev 9 31 of 40 Ne > DR

Step by Step Solution

3.55 Rating (152 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Question Answer to Question 1 Risk and ... View full answer

Get step-by-step solutions from verified subject matter experts