Question: Based on the two tables what can you say about this portfolio manager? Based on the two tables above, what must have been the

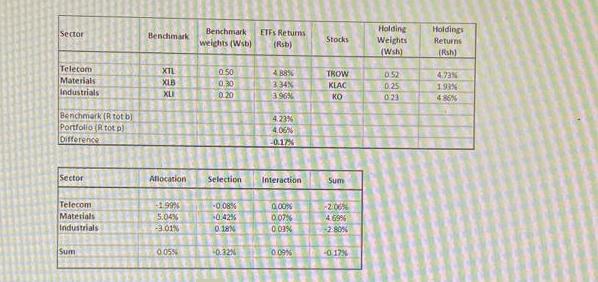

Based on the two tables what can you say about this portfolio manager? Based on the two tables above, what must have been the strongest point of this portfolio manager's performance? Sector Telecom Materials Industrials Benchmark (R tot b) Portfolio (R tot pl Difference Sector Telecom Materials Industrials Sum Benchmark XTL XIB XLI -1.99% 5.04% -3.01% Benchmark weights (Wsb) Allocation Selection 0.05% 0.50 0.30 0.20 -0.08% +0.42% 0.18% -0.32% ETFs Returns (Rsb) 4.88% 3:34% 3.96% 4.23% 4.06% -0.17% Interaction 0,00% 0.07% 0.03% 0.09% Stocks TROW KLAC KO Sum -2,06% 4.69% -2-80% -0.17% Holding Weights (Wsh) 0.52 0.25 023 Holdings Returns (Rsh) 4.73% 1.93% 486%

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Analysis of the Two Tables The two images you provided include a detailed portfolio analysis The fir... View full answer

Get step-by-step solutions from verified subject matter experts