Question: 27. Norine Co, budgets factory overhead (FO) cost split into three activities: assembly, painting. and finishing. Norine plans to manufacture multiple units of three products:

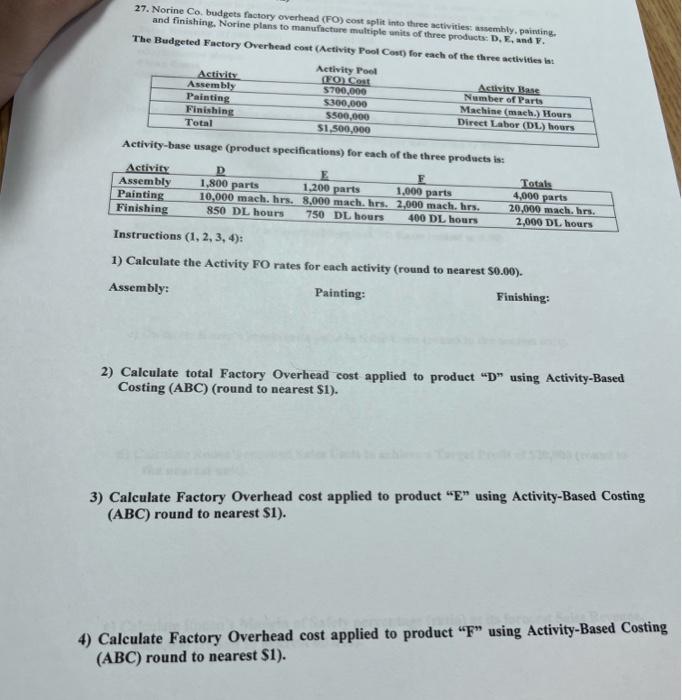

27. Norine Co, budgets factory overhead (FO) cost split into three activities: assembly, painting. and finishing. Norine plans to manufacture multiple units of three products: D, E. , and V. The Budgeted Factory Overhead cost (Aetivity Pool Cost) for each of the throe actuat. A ctivity-base usage (product specifications) for each of the three produete as. Instructions (1,2,3,4) : 1) Calculate the Activity FO rates for each activity (round to nearest 50.00 ). Assembly: Painting: Finishing: 2) Calculate total Factory Overhead cost applied to product "D" using Activity-Based Costing (ABC) (round to nearest \$1). 3) Calculate Factory Overhead cost applied to product "E" using Activity-Based Costing (ABC) round to nearest $1 ). 4) Calculate Factory Overhead cost applied to product "F" using Activity-Based Costing (ABC) round to nearest $1 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts