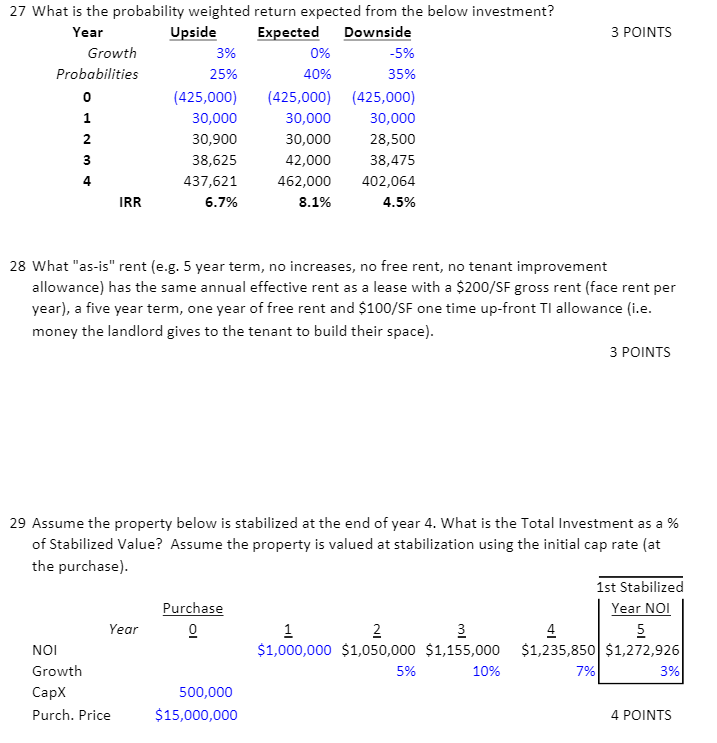

Question: 27 What is the probability weighted return expected from the below investment? Year Upside Expected Downside Growth Probabilities 0 1 NT 2 3 4 IRR

27 What is the probability weighted return expected from the below investment? Year Upside Expected Downside Growth Probabilities 0 1 NT 2 3 4 IRR 3% 25% Year Growth CapX Purch. Price (425,000) 30,000 30,900 38,625 437,621 6.7% 0% 40% 28 What "as-is" rent (e.g. 5 year term, no increases, no free rent, no tenant improvement allowance) has the same annual effective rent as a lease with a $200/SF gross rent (face rent per year), a five year term, one year of free rent and $100/SF one time up-front TI allowance (i.e. money the landlord gives to the tenant to build their space). Purchase 0 -5% 35% 500,000 $15,000,000 (425,000) (425,000) 30,000 30,000 30,000 28,500 42,000 38,475 402,064 462,000 8.1% 4.5% 29 Assume the property below is stabilized at the end of year 4. What is the Total Investment as a % of Stabilized Value? Assume the property is valued at stabilization using the initial cap rate (at the purchase). 1 2 3 $1,000,000 $1,050,000 $1,155,000 5% 10% 3 POINTS 4 $1,235,850 3 POINTS 1st Stabilized Year NOI 7% 5 $1,272,926 3% 4 POINTS 27 What is the probability weighted return expected from the below investment? Year Upside Expected Downside Growth Probabilities 0 1 NT 2 3 4 IRR 3% 25% Year Growth CapX Purch. Price (425,000) 30,000 30,900 38,625 437,621 6.7% 0% 40% 28 What "as-is" rent (e.g. 5 year term, no increases, no free rent, no tenant improvement allowance) has the same annual effective rent as a lease with a $200/SF gross rent (face rent per year), a five year term, one year of free rent and $100/SF one time up-front TI allowance (i.e. money the landlord gives to the tenant to build their space). Purchase 0 -5% 35% 500,000 $15,000,000 (425,000) (425,000) 30,000 30,000 30,000 28,500 42,000 38,475 402,064 462,000 8.1% 4.5% 29 Assume the property below is stabilized at the end of year 4. What is the Total Investment as a % of Stabilized Value? Assume the property is valued at stabilization using the initial cap rate (at the purchase). 1 2 3 $1,000,000 $1,050,000 $1,155,000 5% 10% 3 POINTS 4 $1,235,850 3 POINTS 1st Stabilized Year NOI 7% 5 $1,272,926 3% 4 POINTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts