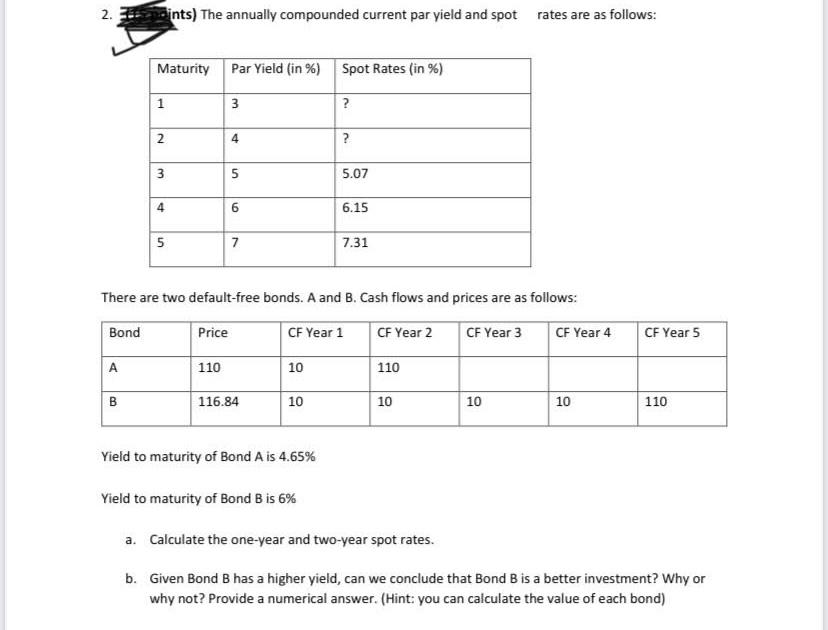

Question: 2.ints) The annually compounded current par yield and spot rates are as follows: Maturity Par Yield (in %) Spot Rates (in %) 1 3 ?

2.ints) The annually compounded current par yield and spot rates are as follows: Maturity Par Yield (in %) Spot Rates (in %) 1 3 ? 2 4 ? 2 3 3 5 5.07 6 6.15 5 5 7 7.31 There are two default-free bonds. A and B. Cash flows and prices are as follows: Bond Price CF Year 1 CF Year 2 CF Year 3 CF Year 4 CF Year 5 A 110 10 110 B 116.84 10 10 10 10 110 Yield to maturity of Bond A is 4.65% Yield to maturity of Bond B is 6% a. Calculate the one year and two-year spot rates. b. Given Bond B has a higher yield, can we conclude that Bond B is a better investment? Why or why not? Provide a numerical answer. (Hint: you can calculate the value of each bond)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts