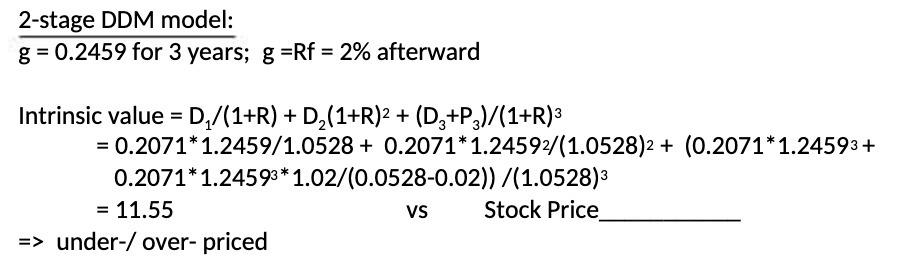

Question: 2-stage DDM model: g = 0.2459 for 3 years; g =Rf = 2% afterward Intrinsic value = D/(1+R) + D(1+R) + (D3+P3)/(1+R) = 0.2071*1.2459/1.0528+

2-stage DDM model: g = 0.2459 for 3 years; g =Rf = 2% afterward Intrinsic value = D/(1+R) + D(1+R) + (D3+P3)/(1+R) = 0.2071*1.2459/1.0528+ 0.2071*1.24592/(1.0528)2 + (0.2071* 1.24593+ 0.2071* 1.24593* = 11.55 => under-/ over-priced 1.02/(0.0528-0.02))/(1.0528) VS Stock Price

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

To determine whether the stock is under or overprice... View full answer

Get step-by-step solutions from verified subject matter experts