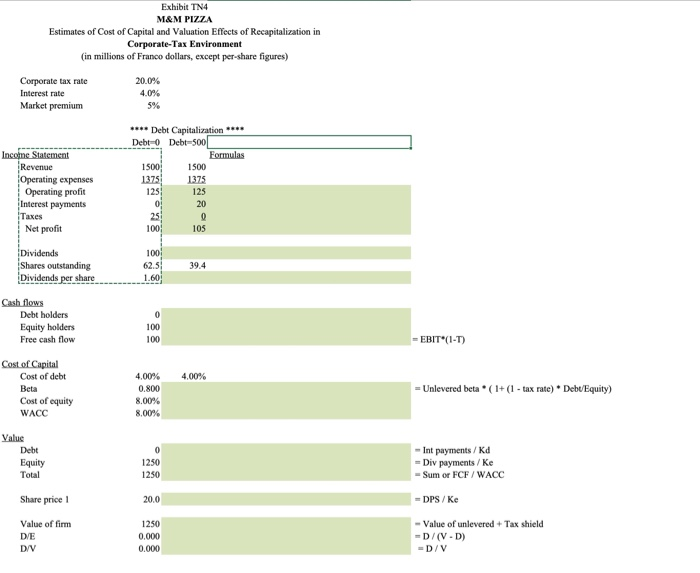

Question: 2.Use Exhibit TN4 spreadsheet. How would your analysis in no-tax situation change if 20% corporate tax is implemented? (Fill out the green-shaded cells) Please note

Exhibit TN4 M&M PIZZA Estimates of Cost of Capital and Valuation Effects of Recapitalization in Corporate Tax Environment (in millions of Franco dollars, except per-share figures) Corporate tax rate 20.0% Interest rate 4.0% Market premium 5% Income Statement Revenue Operating expenses Operating profit Interest payments Taxes Net profit **** Debt Capitalization **** Debt Debt-500 Formulas 1500 1500 1375 1375 125 125 0 20 25 0 105 100 Dividends Shares outstanding Dividends per share 100 62.5 1.60 39.4 Cash flows Debt holders Equity holders Free cash flow 0 100 100 - EBIT*(1-T) 4.00% Cost of Capital Cost of debt Beta Cost of equity WACC 4.00% 0.800 8.00% 8.00% = Unlevered beta *(1+ (1 - tax rate) * Debt'Equity) Value Debt Equity Total 0 1250 1250 - Int payments/Kd - Div payments/ke Sum or FCF/WACC Share price 20.0 DPS/ke Value of firm DVE DAV 1250 0.000 0.000 - Value of unlevered + Tax shield -D/(VD) D/V Exhibit TN4 M&M PIZZA Estimates of Cost of Capital and Valuation Effects of Recapitalization in Corporate Tax Environment (in millions of Franco dollars, except per-share figures) Corporate tax rate 20.0% Interest rate 4.0% Market premium 5% Income Statement Revenue Operating expenses Operating profit Interest payments Taxes Net profit **** Debt Capitalization **** Debt Debt-500 Formulas 1500 1500 1375 1375 125 125 0 20 25 0 105 100 Dividends Shares outstanding Dividends per share 100 62.5 1.60 39.4 Cash flows Debt holders Equity holders Free cash flow 0 100 100 - EBIT*(1-T) 4.00% Cost of Capital Cost of debt Beta Cost of equity WACC 4.00% 0.800 8.00% 8.00% = Unlevered beta *(1+ (1 - tax rate) * Debt'Equity) Value Debt Equity Total 0 1250 1250 - Int payments/Kd - Div payments/ke Sum or FCF/WACC Share price 20.0 DPS/ke Value of firm DVE DAV 1250 0.000 0.000 - Value of unlevered + Tax shield -D/(VD) D/V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts