Question: Audit procedures; identifying deficiencies in payroll systems b) You are the audit senior of Clean Rite Lid and you are carrying out work on the

Audit procedures; identifying deficiencies in payroll systems

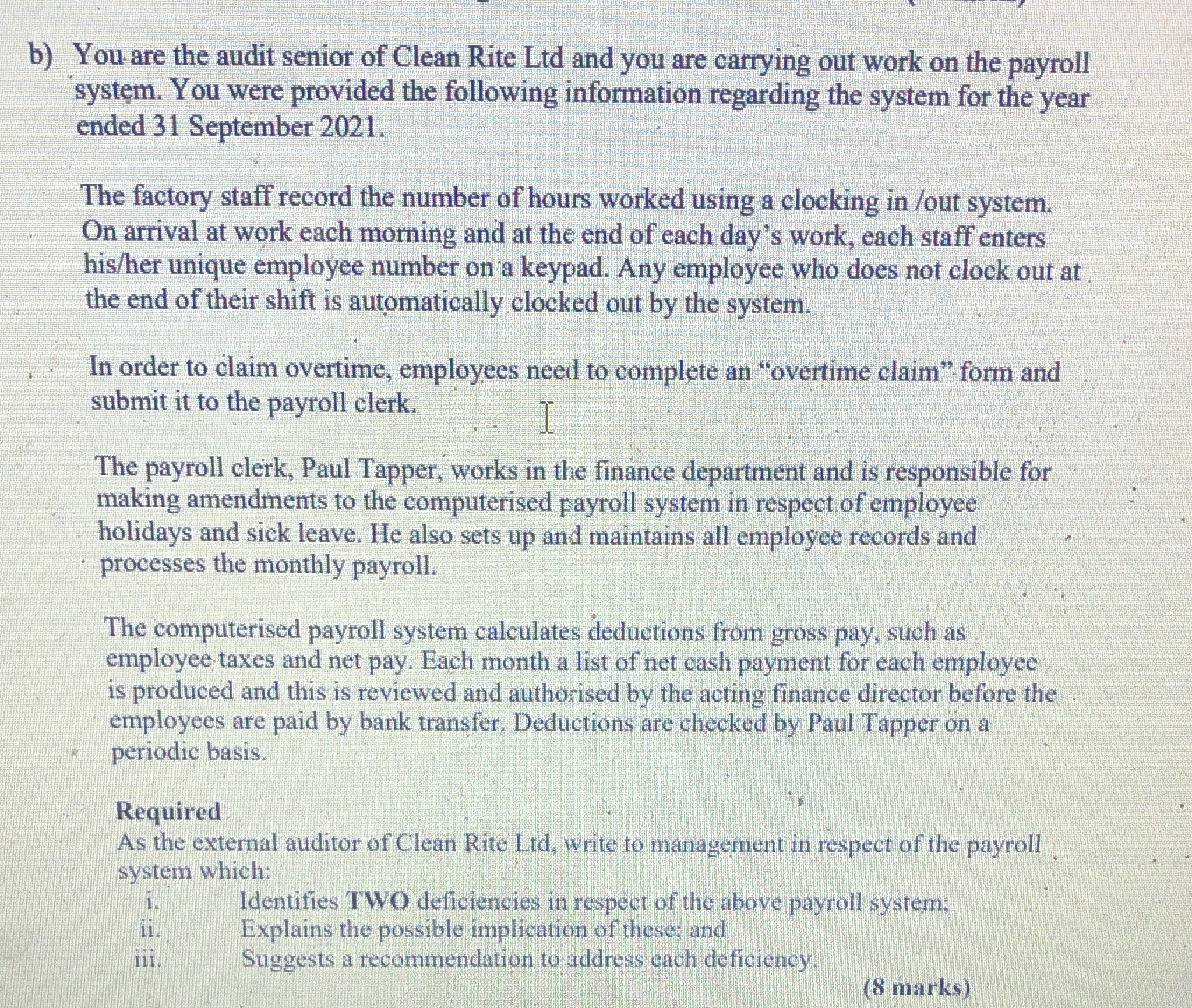

b) You are the audit senior of Clean Rite Lid and you are carrying out work on the payroll system. You were provided the following information regarding the system for the year ended 31 September 2021. The factory staff record the number of hours worked using a clocking in /out system. On arrival at work each morning and at the end of each day's work, each staff enters his/her unique employee number on a keypad. Any employee who does not clock out at the end of their shift is automatically clocked out by the system. In order to claim overtime, employees need to complete an "overtime claim" form and submit it to the payroll clerk. I The payroll clerk, Paul Tapper, works in the finance department and is responsible for making amendments to the computerised payroll system in respect of employee holidays and sick leave. He also sets up and maintains all employee records and processes the monthly payroll. The computerised payroll system calculates deductions from gross pay, such as employee taxes and net pay. Each month a list of net cash payment for each employee is produced and this is reviewed and authorised by the acting finance director before the employees are paid by bank transfer. Deductions are checked by Paul Tapper on a periodic basis. Required As the external auditor of Clean Rite Lid, write to management in respect of the payroll system which: Identifies TWO deficiencies in respect of the above payroll system; 11. Explains the possible implication of these; and Suggests a recommendation to address each deficiency (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts