Question: 3 < a < Question 8 (4 points) Information for Garner Company's direct-labour costs for the month of April 2023 was as follows: 9

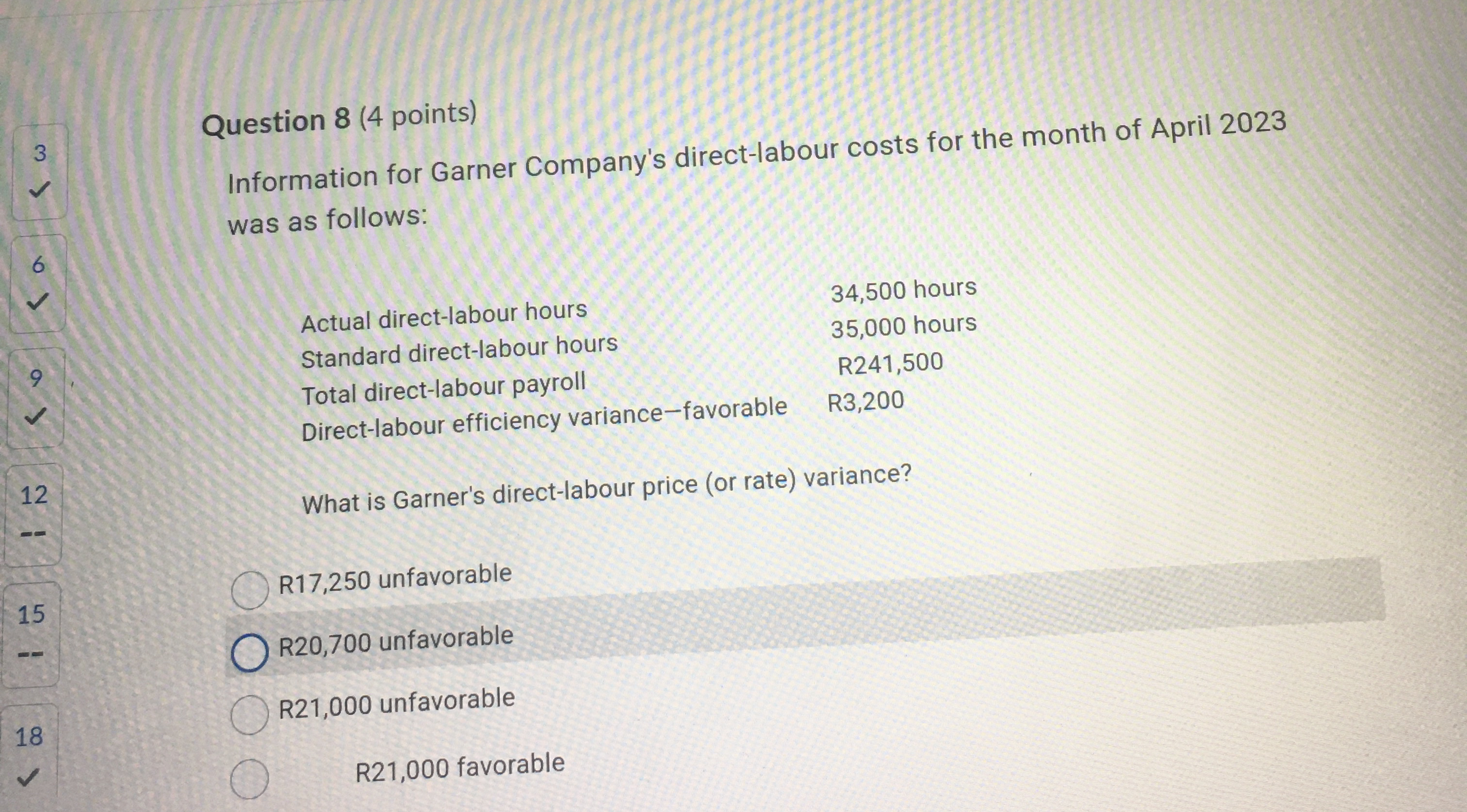

3 < a < Question 8 (4 points) Information for Garner Company's direct-labour costs for the month of April 2023 was as follows: 9 12 15 18 1>> O Actual direct-labour hours Standard direct-labour hours Total direct-labour payroll Direct-labour efficiency variance-favorable 34,500 hours 35,000 hours R241,500 R3,200 What is Garner's direct-labour price (or rate) variance? R17,250 unfavorable R20,700 unfavorable R21,000 unfavorable R21,000 favorable

Step by Step Solution

There are 3 Steps involved in it

Understanding the Problem Were asked to find the direct labor price or rate variance for Garner Company in April 2023 Given Information Actual direct labor hours34500 hours Standard direct labor hours35000 hours Total direct labor payrollR241500 Direct labor efficiency variance favorableR3200 Formula for Direct Labor Price Variance Direct Labor Price Variance Actual Rate Standard Rate Actual Hours Solution Calculate Actual Rate Actual Rate Total Direct Labor Payroll Actual Direct Labor Hours Actual Rate R241500 34500 hours R700 per hour Calculate Standard Rate We dont have the exact standard ratebut we can calculate it using the direct labor efficiency variance Direct Labor Efficiency Variance Standard Rate Actual Hours Standard Rate Standard Hours R3200 Standard Rate 34500 35000 Standard Rate R3200 500 R640 per hour Calculate Direct Labor Price Variance Direct Labor Price Variance R700 R640 34500 hours Direct Labor Price Variance R060 34500 hours R20700 Answer The direct labor price or rate variance for Garner Company in April 2023 is R20700 unfavorable Therefore the correct answer is option B Understanding Direct Labor Price Variance Direct labor price variance measures the difference between the actual cost of labor and the expected standard cost of labor It tells us whether we paid more or less for labor than we planned Breaking Down the Calculation Actual Rate This is the amount we actually paid per hour for labor Calculated by dividing total labor payroll by actual labor hours ... View full answer

Get step-by-step solutions from verified subject matter experts