Question: 3 An individual solves an optimal portfolio problem as follows: < E[[ed] W- e-pt 1-7 max E {a(.)} where his wealth evolves according to

![3 An individual solves an optimal portfolio problem as follows: < E[[ed]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/02/65bf5bddedd23_70965bf5bddb9536.jpg)

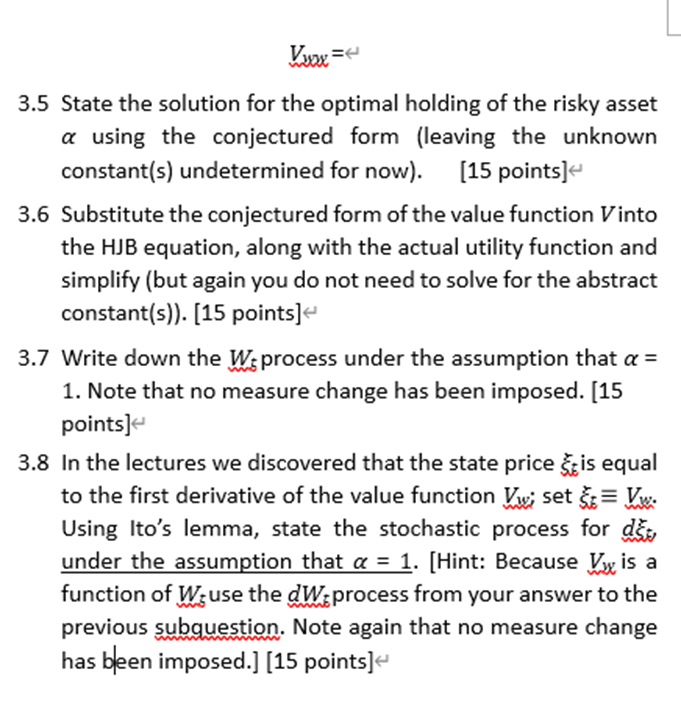

3 An individual solves an optimal portfolio problem as follows: < E[[ed] W- e-pt 1-7 max E {a(.)} where his wealth evolves according to dW= W.(a:(udt + odZ;) + (1 :)rdt) < Notice that does not appear in the utility function or on the right hand side of the wealth equation. < 3.1 Write down the consolidated wealth process dw... 3.2 Write down the HJB equation. < [10 points] [10 points] 3.3 State the optimality condition for the portfolio holding a. [10 points] 3.4 Conjecture a form for V and also state the derivatives V and Vw for the conjectured form. Your conjecture might have one or more constants; because this is an exam I do not expect you to solve for the constant(s)-just carry them forward to this and later questions in abstract form. [10 points] V (w) = < Vw= Vwx= < 3.5 State the solution for the optimal holding of the risky asset a using the conjectured form (leaving the unknown constant(s) undetermined for now). [15 points] 3.6 Substitute the conjectured form of the value function Vinto the HJB equation, along with the actual utility function and simplify (but again you do not need to solve for the abstract constant(s)). [15 points] 3.7 Write down the Wprocess under the assumption that a = 1. Note that no measure change has been imposed. [15 points] 3.8 In the lectures we discovered that the state price is equal to the first derivative of the value function Vi set = Vw. Using Ito's lemma, state the stochastic process for d under the assumption that = 1. [Hint: Because Vis a function of We use the dW.process from your answer to the previous subquestion. Note again that no measure change has been imposed.] [15 points] a

Step by Step Solution

There are 3 Steps involved in it

31 The consolidated wealth process dW can be written as dW W ar udt agdZ 32 The HJB HamiltonJacobiBe... View full answer

Get step-by-step solutions from verified subject matter experts