Question: 3 . Calculate the NPV and IRR using the data from Table 2. Should the project be accepted? File Home Insert Page Layout Formulas Data

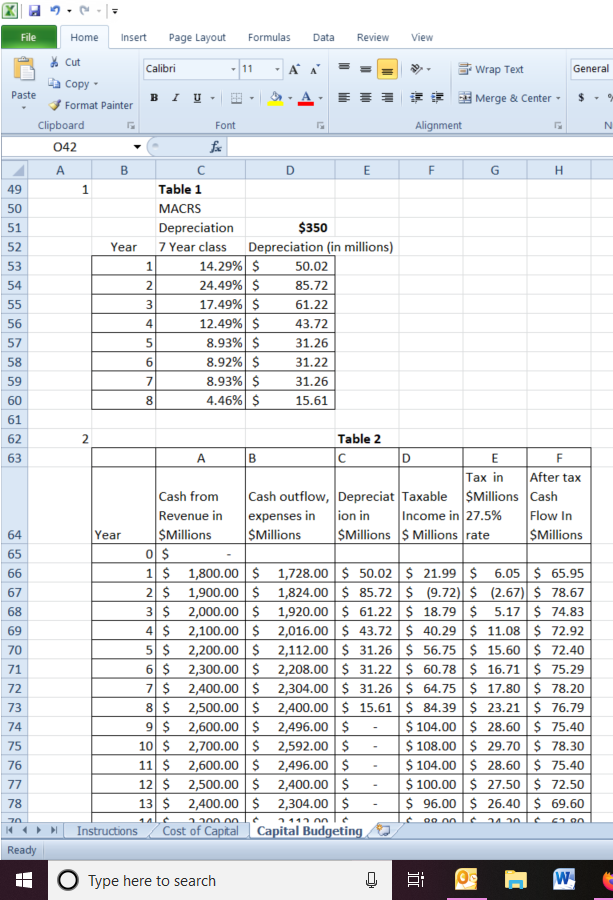

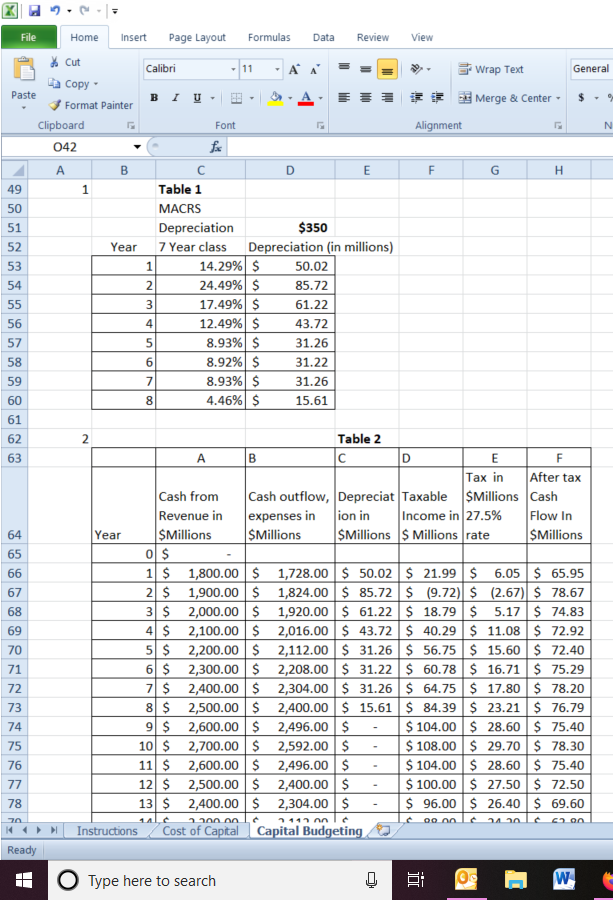

3. Calculate the NPV and IRR using the data from Table 2. Should the project be accepted?

File Home Insert Page Layout Formulas Data Review View * Cut Calibri 11 Wrap Text General En Copy Paste Format Painter B IE E Merge & Center . Clipboard Font Alignment 042 A B C D E F G H 49 1 Table 1 50 MACRS 51 Depreciation $350 52 Year 7 Year class Depreciation (in millions) 53 1 14.29% $ 50.02 54 AWN 24.49% $ 85.72 55 17.49% $ 61.22 56 12.49% 43.72 8.93% $ 31.26 58 8.92% $ 31.22 59 8.93% $ 31.26 60 8 4.46% $ 15.61 61 62 2 Table 2 63 A B C D E F Tax in After tax Cash from Cash outflow, Depreciat Taxable $Millions Cash Revenue in expenses in ion in Income in 27.5% Flow In 64 Year $Millions $Millions $Millions $ Millions rate $Millions 65 o $ 66 1 $ 1,800.00 $ 1,728.00 $ 50.02 $ 21.99 6.05 $ 65.95 67 2 $ 1,900.00 1,824.00 $ 85.72 $ (9.72) $ (2.67) $ 78.67 68 3 $ 2,000.00 S 1,920.00 $ 61.22 $ 18.79 $ 5.17 $ 74.83 69 4 $ 2,100.00 2,016.00 $ 43.72 $ 40.29 $ 11.08 $ 72.92 70 5 $ 2,200.00 $ 2,112.00 $ 31.26 $ 56.75 $ 15.60 $ 72.40 71 6 $ 2,300.00 $ 2,208.00 $ 31.22 $ 60.78 $ 16.71 $ 75.29 72 7 $ 2,400.00 2,304.00 $ 31.26 $ 64.75 $ 17.80 $ 78.20 73 8 $ 2,500.00 2,400.00 $ 15.61 $ 84.39 $ 23.21 $ 76.79 74 9 $ 2,600.00 S 2,496.00 $ 104.00 $ 28.60 $ 75.40 75 10 $ 2,700.00 2,592.00 $ $ 108.00 $ 29.70 $ 78.30 76 11 $ 2,600.00 2,496.00 $ $ 104.00 $ 28.60 $ 75.40 77 12 $ 2,500.00 2,400.00 $ 100.00 $ 27.50 $ 72.50 78 13 $ 2,400.00 S 2,304.00 $ 96.00 $ 26.40 $ 69.60 Hi |Instructions Cost of Capital Capital Budgeting Ready O Type here to search Oe W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts