Question: 3. Castle Plc allocates manufacturing overheads to jobs using a pre-determined overhead absorption/allocation rate based on machine hours. The following information was extracted from the

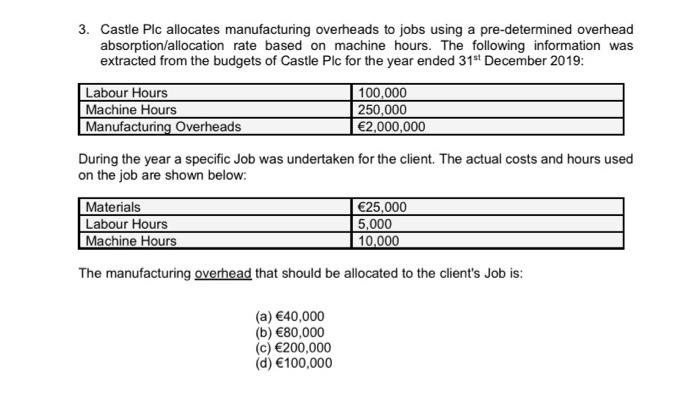

3. Castle Plc allocates manufacturing overheads to jobs using a pre-determined overhead absorption/allocation rate based on machine hours. The following information was extracted from the budgets of Castle Plc for the year ended 31st December 2019: Labour Hours 100,000 Machine Hours 250,000 Manufacturing Overheads 2,000,000 During the year a specific Job was undertaken for the client. The actual costs and hours used on the job are shown below: Materials 25,000 Labour Hours 5,000 Machine Hours 10,000 The manufacturing overhead that should be allocated to the client's Job is: (a) 40,000 (b) 80,000 (c) 200,000 (d) 100,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock