Question: 3. Consider 2 bonds that pay coupons annually. Bond 1 is pays no coupons and matures in 1 year; Bond 2 has coupon 4% and

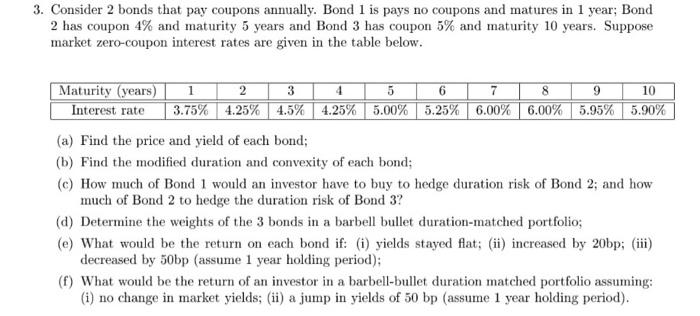

3. Consider 2 bonds that pay coupons annually. Bond 1 is pays no coupons and matures in 1 year; Bond 2 has coupon 4% and maturity 5 years and Bond 3 has coupon 5% and maturity 10 years. Suppose market zero-coupon interest rates are given in the table below. 10 Maturity (years) Interest rate 1 2 7 3.75% 4.25% 4.5% 4.25% 5.00% 5.25% 6.00% 6.00% 5.95% 5.90% (a) Find the price and yield of each bond; (b) Find the modified duration and convexity of each bond; (e) How much of Bond I would an investor have to buy to hedge duration risk of Bond 2; and how much of Bond 2 to hedge the duration risk of Bond 3? (d) Determine the weights of the 3 bonds in a barbell bullet duration-matched portfolio; (e) What would be the return on each bond if: (i) yields stayed flat; (ii) increased by 20bp; (iii) decreased by 50bp (assume 1 year holding period); (f) What would be the return of an investor in a barbell-bullet duration matched portfolio assuming: (i) no change in market yields; (ii) a jump in yields of 50 bp (assume 1 year holding period). 3. Consider 2 bonds that pay coupons annually. Bond 1 is pays no coupons and matures in 1 year; Bond 2 has coupon 4% and maturity 5 years and Bond 3 has coupon 5% and maturity 10 years. Suppose market zero-coupon interest rates are given in the table below. 10 Maturity (years) Interest rate 1 2 7 3.75% 4.25% 4.5% 4.25% 5.00% 5.25% 6.00% 6.00% 5.95% 5.90% (a) Find the price and yield of each bond; (b) Find the modified duration and convexity of each bond; (e) How much of Bond I would an investor have to buy to hedge duration risk of Bond 2; and how much of Bond 2 to hedge the duration risk of Bond 3? (d) Determine the weights of the 3 bonds in a barbell bullet duration-matched portfolio; (e) What would be the return on each bond if: (i) yields stayed flat; (ii) increased by 20bp; (iii) decreased by 50bp (assume 1 year holding period); (f) What would be the return of an investor in a barbell-bullet duration matched portfolio assuming: (i) no change in market yields; (ii) a jump in yields of 50 bp (assume 1 year holding period)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts