Question: 3. Consider a one step binomial tree for the portfolio =SNB which is long shares and short N bonds and the interest rate r is

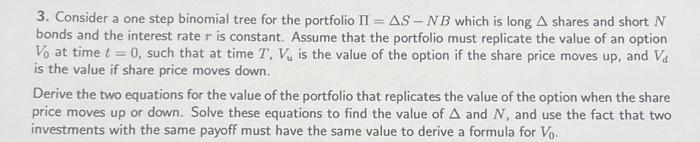

3. Consider a one step binomial tree for the portfolio =SNB which is long shares and short N bonds and the interest rate r is constant. Assume that the portfolio must replicate the value of an option V0 at time t=0, such that at time T,Vu is the value of the option if the share price moves up, and Vd is the value if share price moves down. Derive the two equations for the value of the portfolio that replicates the value of the option when the share price moves up or down. Solve these equations to find the value of and N, and use the fact that two investments with the same payoff must have the same value to derive a formula for V0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts