Question: 3. Consider a project that costs $5 million and involves building a dam and canal to provide water to irrigate desert land that has no

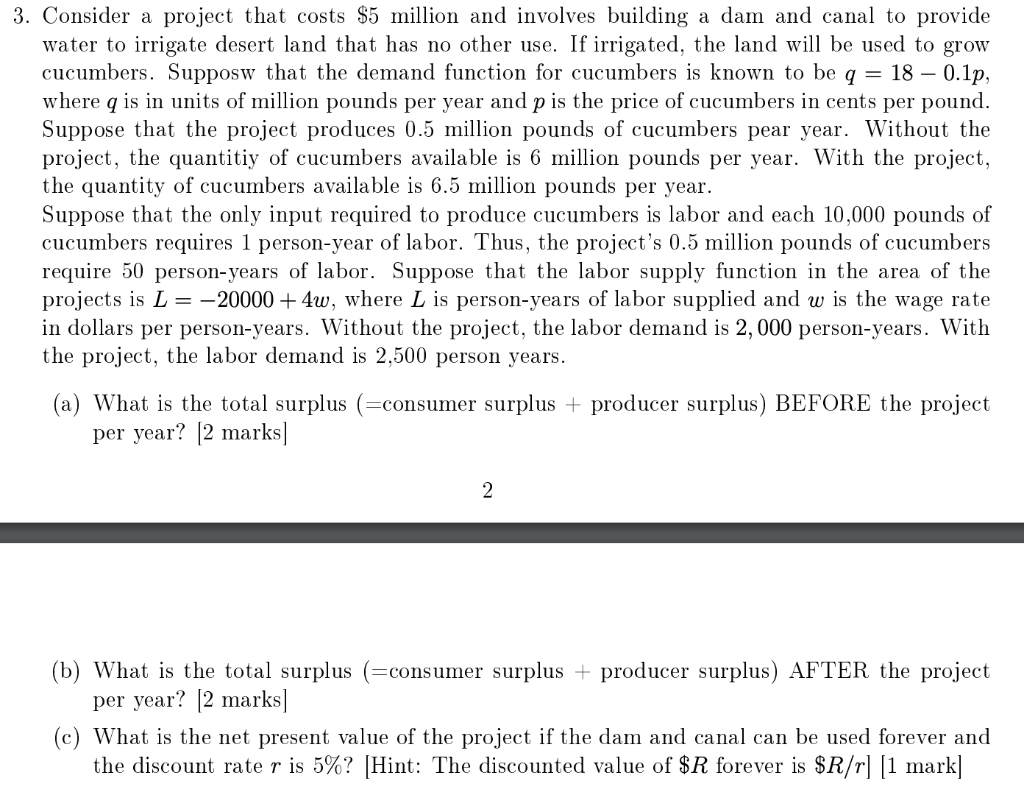

3. Consider a project that costs $5 million and involves building a dam and canal to provide water to irrigate desert land that has no other use. If irrigated, the land will be used to grow cucumbers. Supposw that the demand function for cucumbers is known to be q = 18 0.1p, where q is in units of million pounds per year and p is the price of cucumbers in cents per pound. Suppose that the project produces 0.5 million pounds of cucumbers pear year. Without the project, the quantitiy of cucumbers available is 6 million pounds per year. With the project, the quantity of cucumbers available is 6.5 million pounds per year. Suppose that the only input required to produce cucumbers is labor and each 10,000 pounds of cucumbers requires 1 person-year of labor. Thus, the project's 0.5 million pounds of cucumbers require 50 person-years of labor. Suppose that the labor supply function in the area of the projects is L = -20000 + 4w, where L is person-years of labor supplied and w is the wage rate in dollars per person-years. Without the project, the labor demand is 2, 000 person-years. With the project, the labor demand is 2,500 person years. (a) What is the total surplus (=consumer surplus + producer surplus) BEFORE the project per year? [2 marks (b) What is the total surplus (=consumer surplus + producer surplus) AFTER the project per year? [2 marks (c) What is the net present value of the project if the dam and canal can be used forever and the discount rate r is 5%? (Hint: The discounted value of $R forever is $R/r] [1 mark] 3. Consider a project that costs $5 million and involves building a dam and canal to provide water to irrigate desert land that has no other use. If irrigated, the land will be used to grow cucumbers. Supposw that the demand function for cucumbers is known to be q = 18 0.1p, where q is in units of million pounds per year and p is the price of cucumbers in cents per pound. Suppose that the project produces 0.5 million pounds of cucumbers pear year. Without the project, the quantitiy of cucumbers available is 6 million pounds per year. With the project, the quantity of cucumbers available is 6.5 million pounds per year. Suppose that the only input required to produce cucumbers is labor and each 10,000 pounds of cucumbers requires 1 person-year of labor. Thus, the project's 0.5 million pounds of cucumbers require 50 person-years of labor. Suppose that the labor supply function in the area of the projects is L = -20000 + 4w, where L is person-years of labor supplied and w is the wage rate in dollars per person-years. Without the project, the labor demand is 2, 000 person-years. With the project, the labor demand is 2,500 person years. (a) What is the total surplus (=consumer surplus + producer surplus) BEFORE the project per year? [2 marks (b) What is the total surplus (=consumer surplus + producer surplus) AFTER the project per year? [2 marks (c) What is the net present value of the project if the dam and canal can be used forever and the discount rate r is 5%? (Hint: The discounted value of $R forever is $R/r] [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts