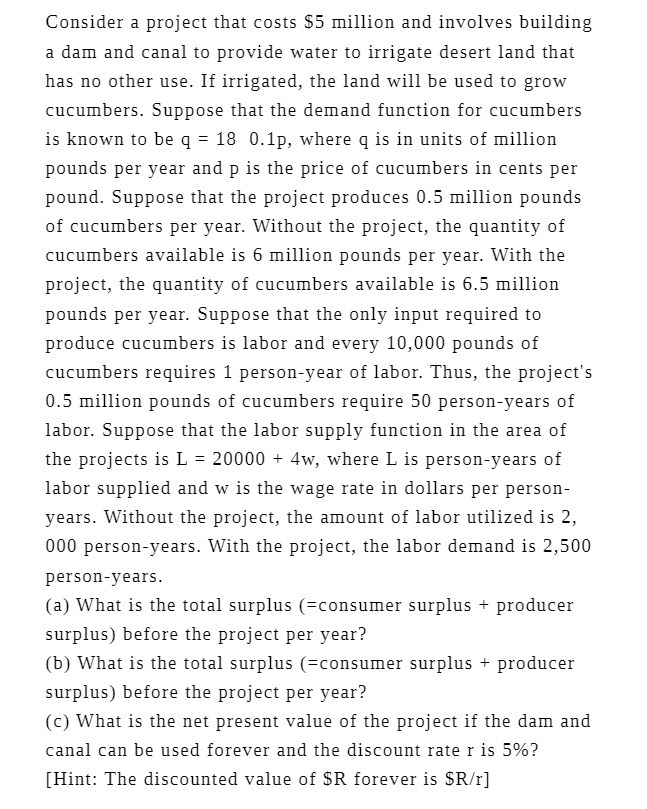

Question: lConsider a project that costs $5 million and involves building a dam and canal to provide water to irrigate desert land that has no other

lConsider a project that costs $5 million and involves building a dam and canal to provide water to irrigate desert land that has no other use. If irrigated, the land will be used to grow cucumbers. Suppose that the demand function for cucumbers is known to be q = 13 II].1p, where q is in units of million pounds per vear and p is the price of cucumbers in cents per pound. Suppose that the project produces 0.5 million pounds of cucumbers per year. Without the project, the quantity,F of cucumbers available is 6 million pounds per vear. With the project, the quantity of cucumbers available is 6.5 million pounds per vear. Suppose that the onlv input required to produce cucumbers is labor and ever}; 1U,{l pounds of cucumbers requires 1 personyear of labor. Thus, the project's ELS million pounds of cucumbers require SD personyears of labor. Suppose that the labor supply function in the area of the projects is L = 20000 + 4w, where L is personvears of labor supplied and w is the wage rate in dollars per person vears. Without the project, the amount of labor utilized is 2, [IUD personyears. With the project, the labor demand is 2,5{l personvears. (a) What is the total surplus {=consumer surplus + producer surplus) before the project per year? (b) What is the total surplus (=consumer surplus + producer surplus) before the project per year? {c} What is the net present value of the project if the dam and canal can be used forever and the discount rate r is 5%? [Hint The discounted value of $R forever is $Rfr]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts