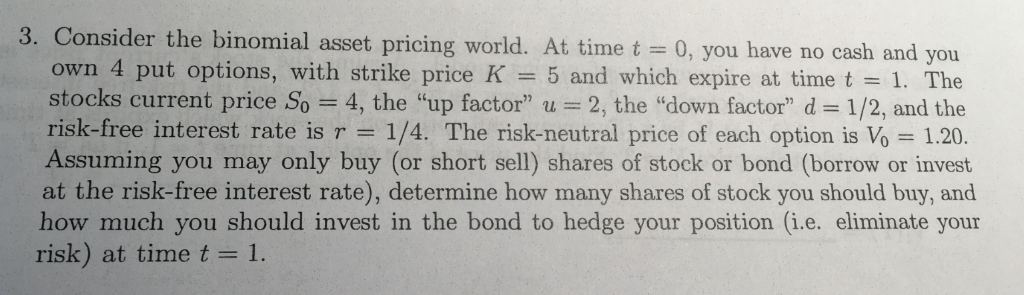

Question: 3. Consider the binomial asset pricing world. At time t 0, you have no cash and you own 4 put options, with strike price K

3. Consider the binomial asset pricing world. At time t 0, you have no cash and you own 4 put options, with strike price K 5 and which expire at time t 1. The stocks current price So 4, the "up factor" u 2, the "down factor" d 1/2, and the risk-free interest rate is r = 1A The risk-neutral price of each option is Vo = 1.20. Assuming you may only buy (or short sell) shares of stock or bond (borrow or invest at the risk-free interest rate), determine how many shares of stock you should buy, and how much you should invest in the bond to hedge your position (i.e. eliminate your risk) at time t 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts