Question: need hand writing 4. (20 points) Consider the binomial asset pricing world. Assume the stock's current price is S0=4, the up factor u=2, the down

need hand writing

need hand writing

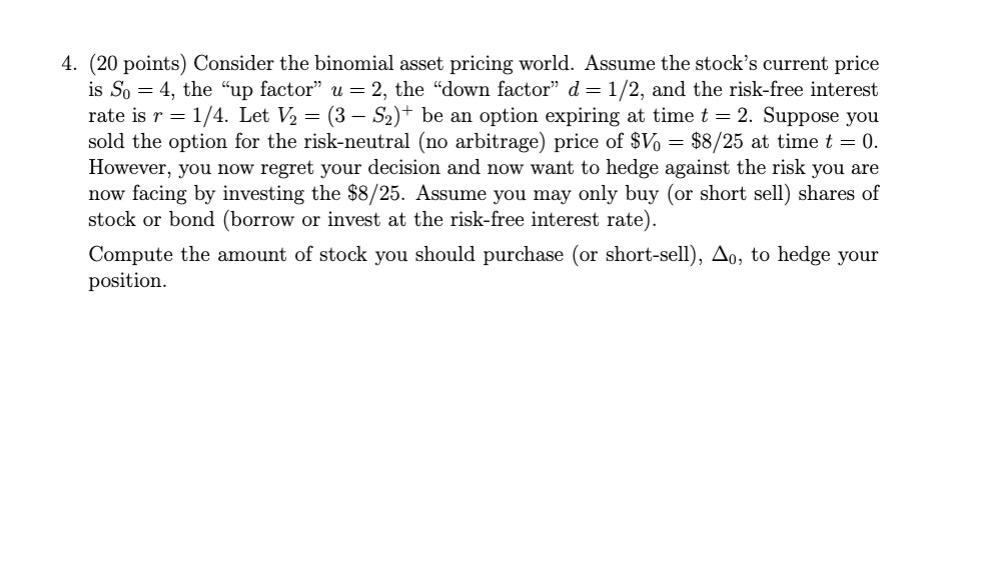

4. (20 points) Consider the binomial asset pricing world. Assume the stock's current price is S0=4, the "up factor" u=2, the "down factor" d=1/2, and the risk-free interest rate is r=1/4. Let V2=(3S2)+be an option expiring at time t=2. Suppose you sold the option for the risk-neutral (no arbitrage) price of $V0=$8/25 at time t=0. However, you now regret your decision and now want to hedge against the risk you are now facing by investing the $8/25. Assume you may only buy (or short sell) shares of stock or bond (borrow or invest at the risk-free interest rate). Compute the amount of stock you should purchase (or short-sell), 0, to hedge your position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts