Question: need hand writing 2. (20 points) Consider the binomial asset pricing world. You own a put option which expires at time t=1 on the stock

need hand writing

need hand writing

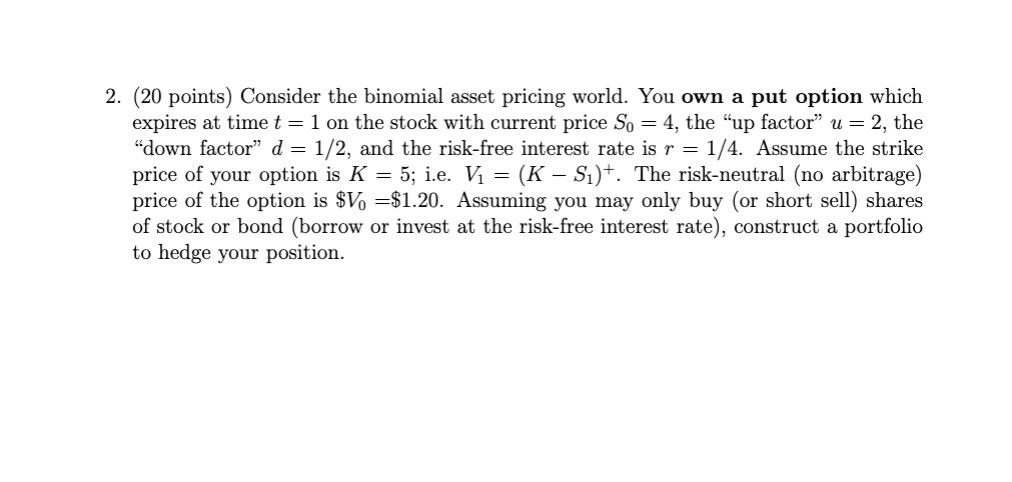

2. (20 points) Consider the binomial asset pricing world. You own a put option which expires at time t=1 on the stock with current price S0=4, the "up factor" u=2, the "down factor" d=1/2, and the risk-free interest rate is r=1/4. Assume the strike price of your option is K=5; i.e. V1=(KS1)+. The risk-neutral (no arbitrage) price of the option is $V0=$1.20. Assuming you may only buy (or short sell) shares of stock or bond (borrow or invest at the risk-free interest rate), construct a portfolio to hedge your position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts