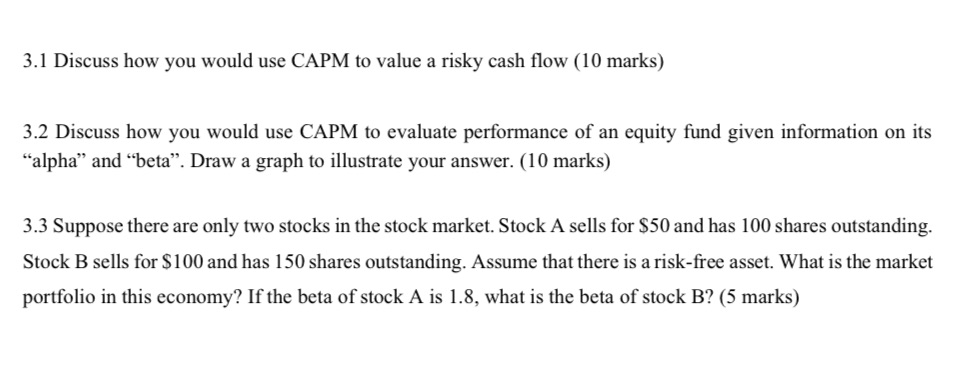

Question: 3.] Discuss how you would use CAPM to value a risky cash ow (10 marks} 3.2 Discuss how you would use CAPM to evaluate performance

![3.] Discuss how you would use CAPM to value a risky](https://s3.amazonaws.com/si.experts.images/answers/2024/06/6675b2f418ffd_5566675b2f40335c.jpg)

3.] Discuss how you would use CAPM to value a risky cash ow (10 marks} 3.2 Discuss how you would use CAPM to evaluate performance of an equity fund given information on its \"alpha" and \"beta\". Draw a graph to illustrate your answer. (10 marks) 3.3 Suppose there are only two stocks in the stock market. Stock A sells for $50 and has 100 shares outstanding. Stock B sells for $100 and has 150 shares outstanding. Assume that there is a risk-free asset. What is the market portfolio in this economy? If the beta of stock A is 1.8, what is the beta of stock B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock