Question: 3. Download the Excel file PS2 Data 1 from NYU Classes. It contains the (actual) annual returns on Coca-Cola (KO) and Walmart (WMT) for 31

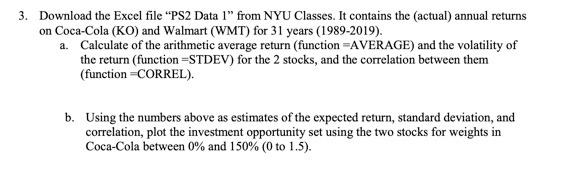

3. Download the Excel file "PS2 Data 1" from NYU Classes. It contains the (actual) annual returns on Coca-Cola (KO) and Walmart (WMT) for 31 years (1989-2019). a. Calculate of the arithmetic average return (function =AVERAGE) and the volatility of the return (function =STDEV) for the 2 stocks, and the correlation between them (function = CORREL). b. Using the numbers above as estimates of the expected return, standard deviation, and correlation, plot the investment opportunity set using the two stocks for weights in Coca-Cola between 0% and 150% ( 0 to 1.5). 3. Download the Excel file "PS2 Data 1" from NYU Classes. It contains the (actual) annual returns on Coca-Cola (KO) and Walmart (WMT) for 31 years (1989-2019). a. Calculate of the arithmetic average return (function =AVERAGE) and the volatility of the return (function =STDEV) for the 2 stocks, and the correlation between them (function = CORREL). b. Using the numbers above as estimates of the expected return, standard deviation, and correlation, plot the investment opportunity set using the two stocks for weights in Coca-Cola between 0% and 150% ( 0 to 1.5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts