Question: 3 Dr. Reddy's Laboratories: Entry in German Market Case Context Standing near the window of his cabin, Mr Sethi was pondering on the decision he

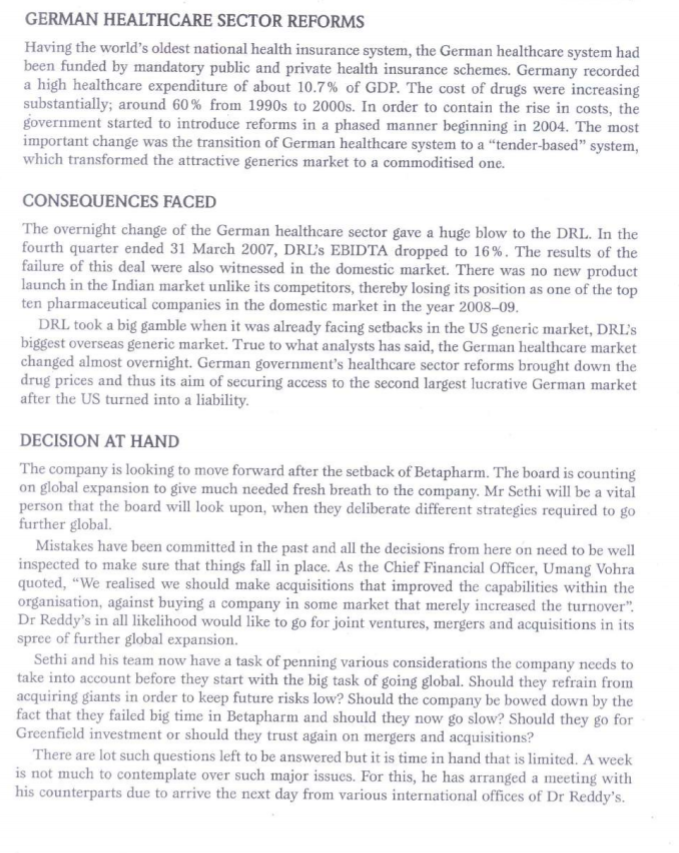

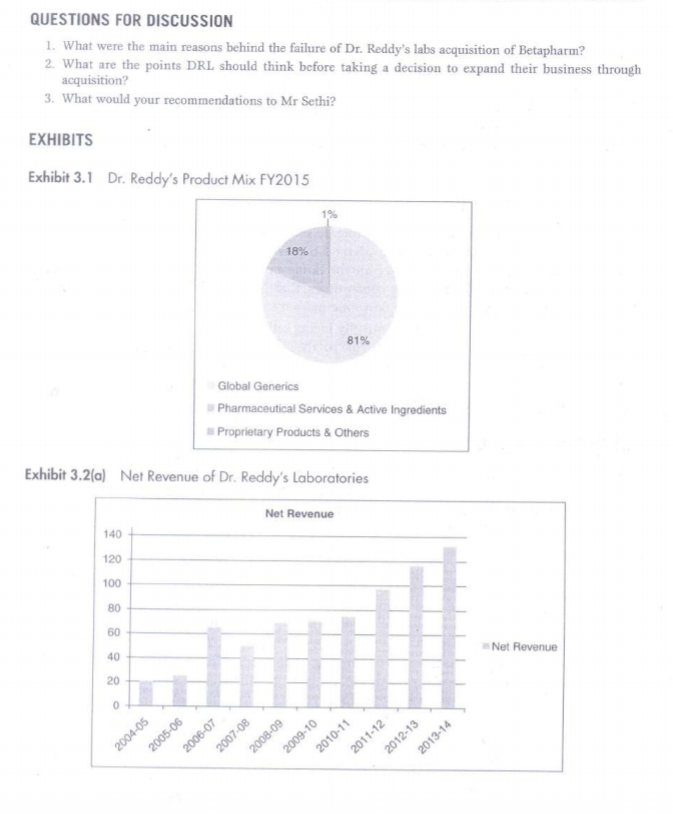

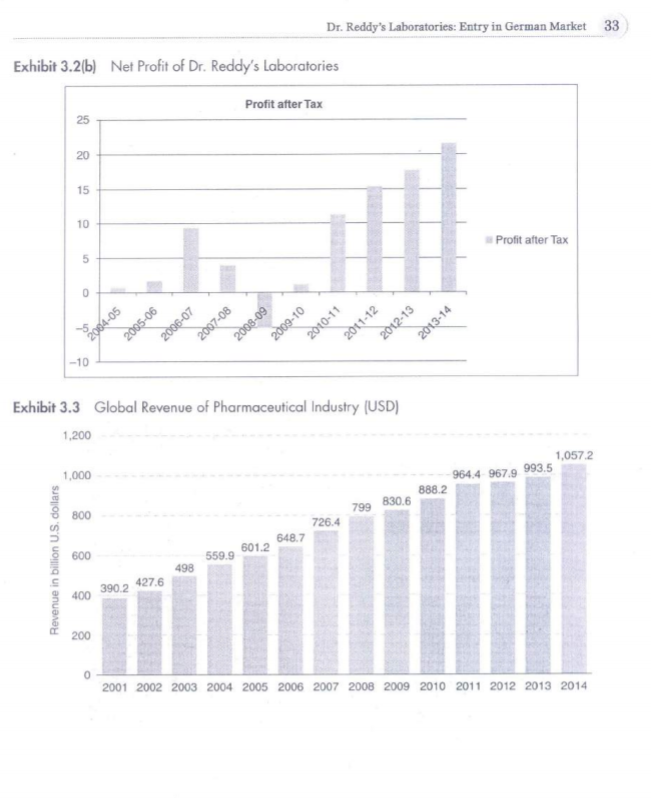

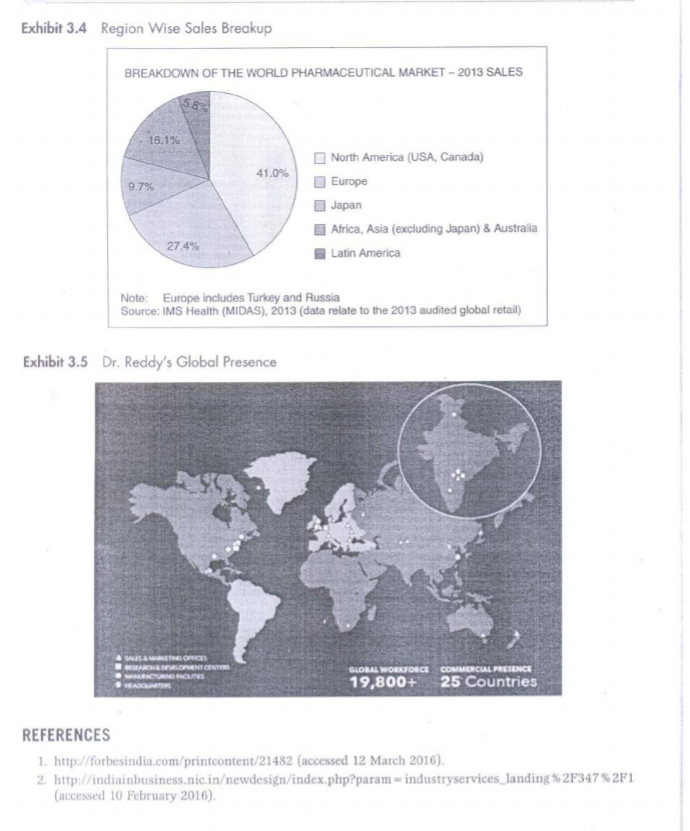

3 Dr. Reddy's Laboratories: Entry in German Market Case Context Standing near the window of his cabin, Mr Sethi was pondering on the decision he took as the CEO of Dr Reddy Laboratory (DRL) to acquire Betapharm in 2006. On the morning of 15 February 2016, it was calm and serene outside, but things were different on this side of the glass. The company had acquired a giant as Betapharm, the fourth-largest generic drug manufacturer in Germany. But things have been gloomy since then. Losses have increased over the years and the situation is not getting any better. As he gets ready to face the Board in the General Meeting due next week, he has some task in his hand. The board is unanimous on the decision to go for further expansion of the $2.3 billion company. However, there is still an underlying fear that things might not turn right, and what if there's another acquisition like Betapharm. INTRODUCTION Based out of Hyderabad, India, Dr Reddy's was founded in 1984 by Anjani Reddy, a scientist and entrepreneur. The company manufactured and promoted an extensive range of pharma- ceuticals in India and abroad for Dr. Reddy's product mix in FY2015 (Exhibit 3.1). In 2015, the company had Net Revenue of US$ 2.38 billion and Net income of US$ 356 million as Revenues and Net Profit (Exhibits 3.2(a) and 3.2(b)). Norilet was the company's first major brand in India after which a series of successes followed, starting with Omez, the branded omeprazole. By 1987, DRL was the only Indian company exporting active elements for pharmaceuticals to European nations. It was only at the end of year that the company got into the business of manufacturing pharmaceutical products rather than just an exporter of active elements. As per a study by Trust Research Advisory (2015), a brand analytics company, Dr Reddy's ranked among 1200 of India's most trusted brands. GLOBAL PHARMACEUTICAL MARKET The pharmaceutical business sector had encountered some significant challenges in BRIC countries. The emerging markets were rapidly getting up to speed to those of developed nations like North America, Europe and Japan. The North American industry expanded by 12% while Latin America's incomes expanded by 17% in 2014. Emerging markets comprised 23 % of the industries fairly estimated worth in 2014, in contrast with just 13% in 2006. Countries such as China were quickly transforming the pharmaceutical sector. China's five-year arrangement from 2011 to 2015 was expected to redesign the health care framework and expansion protec- tion scope (see Exhibit 3.3 for global revenue of pharmaceutical industry). Government jolt, expanded health mindfulness and enhanced R&D abilities had driven China's pharmaceutical industry development. An inexorably huge and maturing population had further extended the healthcare framework. The nation produced $109.3 billion as pharmaceutical industry income in 2014. The pharmaceutical industry in countries such as China had numerous open doors that were helpful for its development Exhibit 3.4). In 2013, the North American pharmaceutical business sector created 322.5 billion Euros in income while Asia, Africa and Australia, aggregately, represented 246.8 billion Euros alto gether. Dr. Reddy's Global presence was also evident to share some portion of this revenue (Exhibits 3.5 and 3.1). In 2015, the worldwide pharmaceutical industry was worth right around 1.1 trillion US dollars in business sector esteem. INDIAN PHARMACEUTICAL MARKET As far as volume was concerned, the Indian pharmaceuticals business sector was the third biggest. And as for worth, it stood thirteenth all-inclusive, according to a report by Equity Master. Out of aggregate business sector, branded generics constituted 70 to 80% of the overall industry. India was the biggest supplier of nonexclusive medications comprehensively with the Indian generics representing 20% of worldwide fares regarding volume. Recently, union had turned into a critical normal for the Indian pharmaceutical business sector as the industry was exceptionally fragmented. India appreciated an essential position in the worldwide pharmaceuticals part. The nation likewise had a huge pool of researchers and architects who could possibly control the industry ahead to a considerably more elevated amount The UN-sponsored Medicines Patent Pool had marked six sub-licenses with Aurobindo, Cipla, Desano, Emcure, Hetero Labs and Laurus Labs, permitting them to make non-specific against AIDS drug Tenofovir Alafenamide (TAF) for 112 creating nations. GROWING MARKET IN INDIA The Indian pharmaceutical industry was estimated to grow at 20% compound annual growth rate (CAGR) over the next five years according to India Ratings, a Fitch company (2015). The Indian pharmaceutical industry, which relied upon to develop more than 15% for each annum somewhere around 2015 and 2020, will beat the worldwide pharmaceutical industry, which was set to develop at a yearly rate of 5 percent between the same periods. In the blink of an eye the business sector size of the pharmaceutical industry in India remained at US$ 20 billion. As on March 2014, Indian pharmaceutical assembling offices enrolled with the US Food and Drug Administration (FDA) remained at 523, most elevated for any nation outside the United States. Indian pharmaceutical firms were peering toward acquisition opportunities in Japan's devel- oping generic business sector as the Japanese government expected to build the entrance of generic medications to 60 percent of the business sector by 2017 from 30 percent in 2014, because of maturing population and rising well-being costs. India's pharmaceuticals industry contained, bio-pharmaceuticals, bio-services, bio-horticul ture, bio-industry and bioinformatics, was growing at a rate of around 30% per year and was estimated to achieve US$ 100 billion by 2025. Biopharma, involving immunisations, therapeu- tics and diagnostics, was the biggest sub-segment contributing almost 62% of the aggregate incomes at Rs 12,600 crore (US$ 1.9 billion). EXPANDING INTERNATIONAL Russia was the first location in Dr Reddy's quest to expand global in 1992. Here, the company went into joint venture with Biomed, Russia's biggest pharmaceuticals manufacturer. However, the success of Joint Venture was short lived and in a span of 3 years, Dr Reddy's sold the same to Kremlin-friendly Sistema group. It was a scandal that led to major financial setback, forcing the company to take the extreme step. However, by 1993, Dr Reddy's had entered into another Joint Venture in the Middle East. Amidst this, the company had setup a couple of formulation units which proved to be the game changer. Now, the company would export active pharma- ceutical ingredients to these units which would then convert them to finished products. It was in 1994 that Dr Reddy's started to look beyond Europe and Middle East and it was at that time that the United States came into its radar. The company then started building state of the art manufacturing facilities in the states and focused on the US generic market. Dr. Reddy's Laboratories was also planning to extend its access in Europe and develop its proprietary products business through the next two years. The organisation was looking to go ahead through mergers and acquisitions. DRL was doing good business in USA, earning around 45 % revenue and Russia becoming the second largest market abroad. In the United States, pharmaceutical organisations faced stiff competition and tight regulations. Europe (excluding Russia) contributed just four percent to the total income and Dr Reddy's was looking forward to grow the business in France, Italy and Spain in the coming years. At present, the proprietary products contributed three to four in revenues and the company would like to develop the share and expect approval from the US Food and Drug Administration The organisation would anticipate that the proprietary business to grow sizably in the next three to four years. ENTRY IN EUROPEAN MARKET DRL's entry into Europe could be categorised according to its business portfolio. The business portfolio of DRL business processes could be broadly categorised as: Research and Development (R&D); Active Pharmaceutical Ingredients (API) and Formulations. R&D included estab- lishing R&D centers and undertaking R&D initiatives in overseas; API is a chemical molecule in a pharma product that gave the claimed therapeutic effect; formulations produced API and then also manufactured final product and this was the end product of the medicine manufac- turing process. In 1987, DRL started to export APIs to Europe and thus became the first Indian phar- maceutical company to export APIs to Europe. DRL strengthened its European operations with the acquisition of two pharmaceutical firms in the United Kingdom in 2002. BMS Labs and Meridian were the two firms, which were acquired by DRL and thus allowed Reddy's to expand geographically in the European market. In the late 2000, DRL installed two R&D centers for generics research; one in the UK and one in Netherlands. In spite of its continuous, acquisitions and expansion strategies in Europe, the European continent contributed only 4% revenue to DRL in the early 2000. DRL'S Challenges DRL had few setbacks in early 2000s against pharmaceutical industry giants Novo Nordisk and Pfizer. Its foray into drug discovery led the Indian pharmaceutical giant into a huge loss; profits had fallen down to 87.3% from 2003 to 2004. Also the initiatives of Big Pharmaceutical companies of the US to pre-empt generic companies from eating into their sales, made US a battleground for DRL. DRL, in order to achieve its vision of becoming a billion dollar company; to move forward with its geographical expansion strategy and to overcome its losses started courting Betapharm. ROLE OF GOVERNMENT Dr Reddy's gave a high measure of annual tax to the government for producing, importing and exporting items. The new regulations in Indian Drug Pricing Policy termed the drug pricing as irrational and unreasonable. A government committee investigated the drug pricing mecha nism, as there had been claims that the organisations were making huge margins, which goes very high. This prompted higher costs and contract net revenues which burdened for both, the company and the industry. Furthermore, Russia had passed a law, which mandated pharmaceutical suppliers to setup local plants in order to get the permit of distributing their items in the Russian market. This would prompt higher tax assessment in the Russian market too. Nonetheless, the relationship between Dr Reddy and Russia suggested that the company is supportive of such a thought as it would open its new supply channels towards Eastern European nations. A special purpose program supported the rebuilding of the Russian pharmaceutical industry, which proved to be beneficial for Dr Reddy's to deliver in future in this market. BETAPHARM ACQUISITION Around 66% of the world's second largest European generic market was held by Germany Betapharm, which was acquired by a US-based private equity firm 3i in 2004, was the fourth largest generic pharma company in Germany. Being one of the established one-stop-shops' of the German generic market, Betapharm also had a well-established distribution channels in Germany. Stalking the Betapharm for over two years, finally in February 2006, DRL acquired 100 % stake in Betapharm for $560 million, which was considered as India's first major Merger and Acquisition in pharmaceutical sector. GERMAN HEALTHCARE SECTOR REFORMS Having the world's oldest national health insurance system, the German healthcare system had been funded by mandatory public and private health insurance schemes. Germany recorded a high healthcare expenditure of about 10.7% of GDP. The cost of drugs were increasing substantially, around 60% from 1990s to 2000s. In order to contain the rise in costs, the government started to introduce reforms in a phased manner beginning in 2004. The most important change was the transition of German healthcare system to a tender-based" system, which transformed the attractive generics market to a commoditised one. CONSEQUENCES FACED The overnight change of the German healthcare sector gave a huge blow to the DRL. In the fourth quarter ended 31 March 2007, DRL'S EBIDTA dropped to 16%. The results of the failure of this deal were also witnessed in the domestic market. There was no new product launch in the Indian market unlike its competitors, thereby losing its position as one of the top ten pharmaceutical companies in the domestic market in the year 2008-09. DRL took a big gamble when it was already facing setbacks in the US generic market, DRLs biggest overseas generic market. True to what analysts has said, the German healthcare market changed almost overnight. German government's healthcare sector reforms brought down the drug prices and thus its aim of securing access to the second largest lucrative German market after the US turned into a liability. DECISION AT HAND The company is looking to move forward after the setback of Betapharm. The board is counting on global expansion to give much needed fresh breath to the company. Mr Sethi will be a vital person that the board will look upon, when they deliberate different strategies required to go further global. Mistakes have been committed in the past and all the decisions from here on need to be well inspected to make sure that things fall in place. As the Chief Financial Officer, Umang Vohra quoted, We realised we should make acquisitions that improved the capabilities within the organisation, against buying a company in some market that merely increased the turnover". Dr Reddy's in all likelihood would like to go for joint ventures, mergers and acquisitions in its spree of further global expansion. Sethi and his team now have a task of penning various considerations the company needs to take into account before they start with the big task of going global. Should they refrain from acquiring giants in order to keep future risks low? Should the company be bowed down by the fact that they failed big time in Betapharm and should they now go slow? Should they go for Greenfield investment or should they trust again on mergers and acquisitions? There are lot such questions left to be answered but it is time in hand that is limited. A week is not much to contemplate over such major issues. For this, he has arranged a meeting with his counterparts due to arrive the next day from various international offices of Dr Reddy's. QUESTIONS FOR DISCUSSION 1. What were the main reasons behind the failure of Dr. Reddy's labs acquisition of Betapharm? 2. What are the points DRL should think before taking a decision to expand their business through acquisition? 3. What would your recommendations to Mr Sethi? EXHIBITS Exhibit 3.1 Dr. Reddy's Product Mix FY2015 18% 81% Global Generics Pharmaceutical Services & Active Ingredients Proprietary Products & Others Exhibit 3.2(a) Net Revenue of Dr. Reddy's Laboratories Net Revenue 140 120 100 80 50 Net Revenue 40 20 0 2005-06 2007-08 2009-10 2013-14 2004-05 2006-07 2008-09 2010-11 2011-12 2012-13 5 A- 05 Dr. Reddy's Laboratories: Entry in German Market 33 Exhibit 3.2(6) Net Profit of Dr. Reddy's Laboratories Profit after Tax 25 20 15 10 Profit after Tax 5 0 2006-07 2010-11 2009-10 2088-09 2012-13 2013-14 2005-06 2007-08 2011-12 -10 Exhibit 3.3 Global Revenue of Pharmaceutical Industry (USD) 1,200 1,0572 1,000 964.4 967,9 993.5 888.2 799 830.6 800 726.4 648.7 Revenue in billion U.S. dollars 600 601.2 559.9 498 427.6 400 390.2 200 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 35 Dr. Reddy's Laboratories: Entry in German Market 3. http://www.ibef.org/industry/pharmaceutical-india.aspx (accessed 11 February 2016). 4. http://www.icmrindia.org/casestudies/catalogue/Business%20Strategy/Dr%20Reddys%20Laboratories- Excerpts 1.htm (accessed 17 September 2015) 5. http://www.moneycontrol.com/bse_annualreports/5001240315.pdf (accessed 12 March 2016). 6. http://www.trustadvisory.info/ (accessed 5 August 2015). 7. https://www.indiaratings.co.in/about-us/overview (accessed 10 May 2015). QUESTIONS FOR DISCUSSION 1. What were the main reasons behind the failure of Dr. Reddy's labs acquisition of Betapharm? 2. What are the points DRL should think before taking a decision to expand their business through acquisition? 3. What would your recommendations to Mr Sethi

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock