Question: 3) Evaluate the project using other capital budgeting techniques such as compensation period, limited restitution period, inner pace of return, and gainfulness record. Recommend a

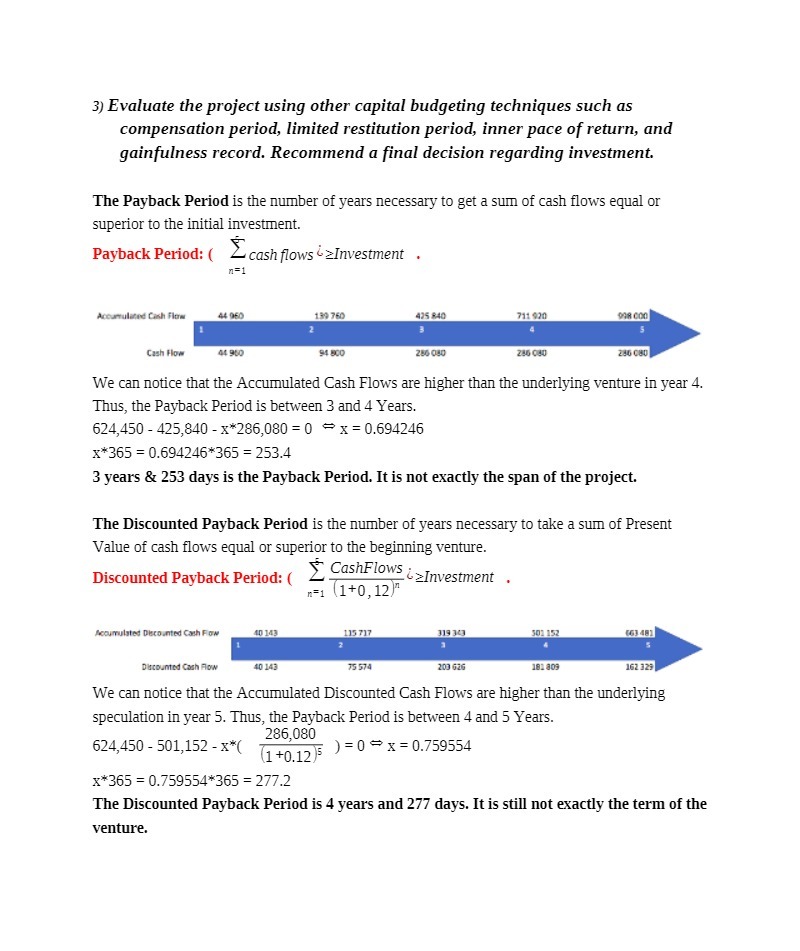

3) Evaluate the project using other capital budgeting techniques such as compensation period, limited restitution period, inner pace of return, and gainfulness record. Recommend a final decision regarding investment. The Payback Period is the number of years necessary to get a sum of cash flows equal or superior to the initial investment. Payback Period: ( 2 cash flows =Investment . Accumulated Cash Flow 44 050 130 760 425 640 711 920 Cash Flow 41 950 94 800 286 080 286 080 We can notice that the Accumulated Cash Flows are higher than the underlying venture in year 4. Thus, the Payback Period is between 3 and 4 Years. 624,450 - 425,840 - x*286,080 = 0 = x = 0.694246 x*365 = 0.694246*365 = 253.4 3 years & 253 days is the Payback Period. It is not exactly the span of the project. The Discounted Payback Period is the number of years necessary to take a sum of Present Value of cash flows equal or superior to the beginning venture. Discounted Payback Period: ( 2 CashFlows &=Investment . "=1 (1+0, 12)" Accumulated Discounted Cash Flow 40 143 115 717 319 343 01 152 (63 481 Discounted Cash Flow 40 143 75 574 203 G2 181 809 162 329 We can notice that the Accumulated Discounted Cash Flows are higher than the underlying speculation in year 5. Thus, the Payback Period is between 4 and 5 Years. 286,080 624,450 - 501,152 - x*( (1+0.12 5 ) = 0 - x = 0.759554 x*365 = 0.759554*365 = 277.2 The Discounted Payback Period is 4 years and 277 days. It is still not exactly the term of the venture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts