Question: 3. In this exercise, select any two (A and B) of the five companies to form a two-asset portfolio. Combine the companies so that A

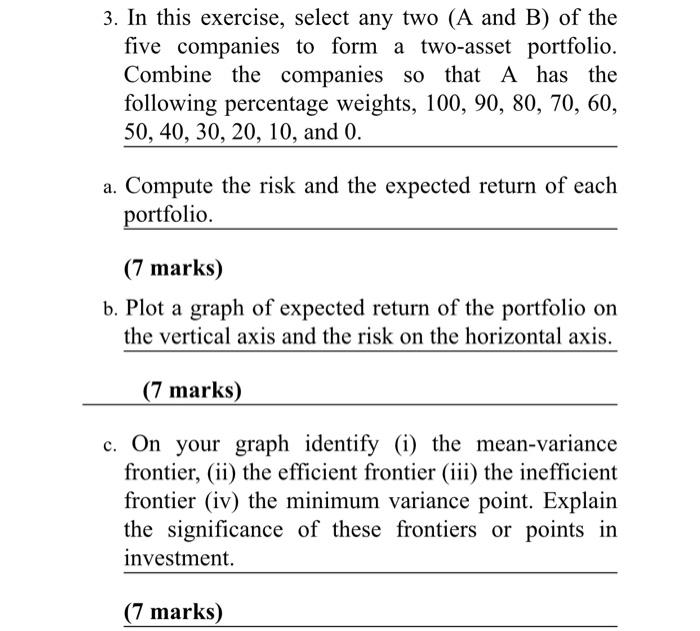

3. In this exercise, select any two (A and B) of the five companies to form a two-asset portfolio. Combine the companies so that A has the following percentage weights, 100, 90, 80, 70, 60, 50, 40, 30, 20, 10, and 0. a. Compute the risk and the expected return of each portfolio. (7 marks) b. Plot a graph of expected return of the portfolio on the vertical axis and the risk on the horizontal axis. (7 marks) c. On your graph identify (i) the mean-variance frontier, (ii) the efficient frontier (iii) the inefficient frontier (iv) the minimum variance point. Explain the significance of these frontiers or points in investment. (7 marks) 3. In this exercise, select any two (A and B) of the five companies to form a two-asset portfolio. Combine the companies so that A has the following percentage weights, 100, 90, 80, 70, 60, 50, 40, 30, 20, 10, and 0. a. Compute the risk and the expected return of each portfolio. (7 marks) b. Plot a graph of expected return of the portfolio on the vertical axis and the risk on the horizontal axis. (7 marks) c. On your graph identify (i) the mean-variance frontier, (ii) the efficient frontier (iii) the inefficient frontier (iv) the minimum variance point. Explain the significance of these frontiers or points in investment. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts