Question: 3. Let return be the total return from holding a firm's stock over the four-year period from the end of 1990 to the end of

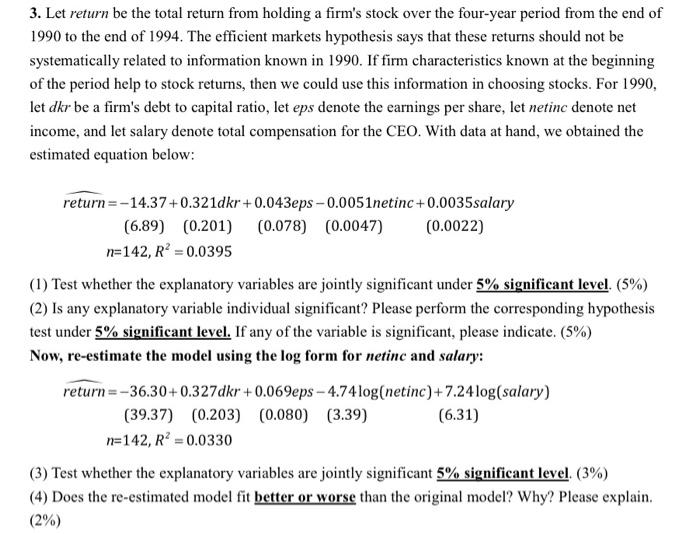

3. Let return be the total return from holding a firm's stock over the four-year period from the end of 1990 to the end of 1994. The efficient markets hypothesis says that these returns should not be systematically related to information known in 1990. If firm characteristics known at the beginning of the period help to stock returns, then we could use this information in choosing stocks. For 1990, let dkr be a firm's debt to capital ratio, let eps denote the earnings per share, let netinc denote net income, and let salary denote total compensation for the CEO. With data at hand, we obtained the estimated equation below: return=-14.37+0.321dkr +0.043eps -0.0051netinc +0.0035 salary (6.89) (0.201) (0.078) (0.0047) (0.0022) n=142, R = 0.0395 (1) Test whether the explanatory variables are jointly significant under 5% significant level. (5%) (2) Is any explanatory variable individual significant? Please perform the corresponding hypothesis test under 5% significant level. If any of the variable is significant, please indicate. (5%) Now, re-estimate the model using the log form for netinc and salary: return=-36.30+0.327dkr +0.069eps - 4.74 log(netinc)+7.24 log(salary) (39.37) (0.203) (0.080) (3.39) (6.31) n=142, R2 = 0.0330 (3) Test whether the explanatory variables are jointly significant 5% significant level. (3%) (4) Does the re-estimated model fit better or worse than the original model? Why? Please explain. (2%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts