Question: 3. Measuring standalone risk using reallized (historical) data Returns eamed over a given time period are called realized rotums. Historical data on realized retums is

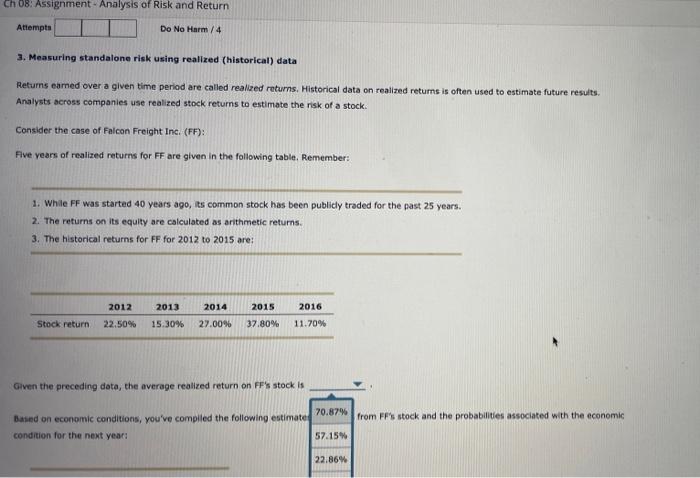

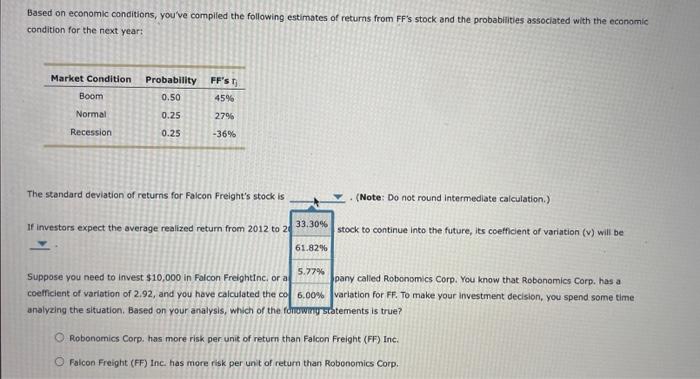

3. Measuring standalone risk using reallized (historical) data Returns eamed over a given time period are called realized rotums. Historical data on realized retums is often used to estimate future results. Analysts across companies use realized stock returns to estimate the risk of a stock. Consider the cose of Falcon Freight Inc. (FF): Five vears of realized returns for FF are given in the following table, Remember: 1. While FF was started 40 years ago, its common stock has been publicly traded for the past 25 years. 2. The returns on its equity are calculated as arithmetic retums. 3. The historical returns for FF for 2012 to 2015 are: Given the preceding data, the average realized return on FF's stock is Batind on econemic conditions, you've compiled the following estimate from FF's stock and the probabilities associated with the economic condition for the next year: Based on economic conditions, you've compiled the following estimates of retums from FF's stock and the probabilities associated with the economic condition for the next year: The standard deviation of returns for Faicon Freight's stock is (Note: Do not round intermediate calculation.) Suppose you need to invest $10,000 in Falcon Freightinc, or a 5.77% pany called Robonomics Corp. You know that Robonomics Corp. has a coefficient of variation of 2.92, and you have calculated the co 6.00% variation for FF. To make your investment decision, you spend some time analyzing the situation. Based on your analysis, which of the foliwanystatements is true? Robonomics Corp, has more risk per unit of return than Falcon Freight (FF) Inc. Falcon Freight (FF) Ine. has more risk per unt of return than Robonomics Corp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts