Question: 3 NBS-5902A Version 1 SECTION A Answer BOTH questions 1 and 2 in Section A Question 1. Pezam plc has produced the following trial balance

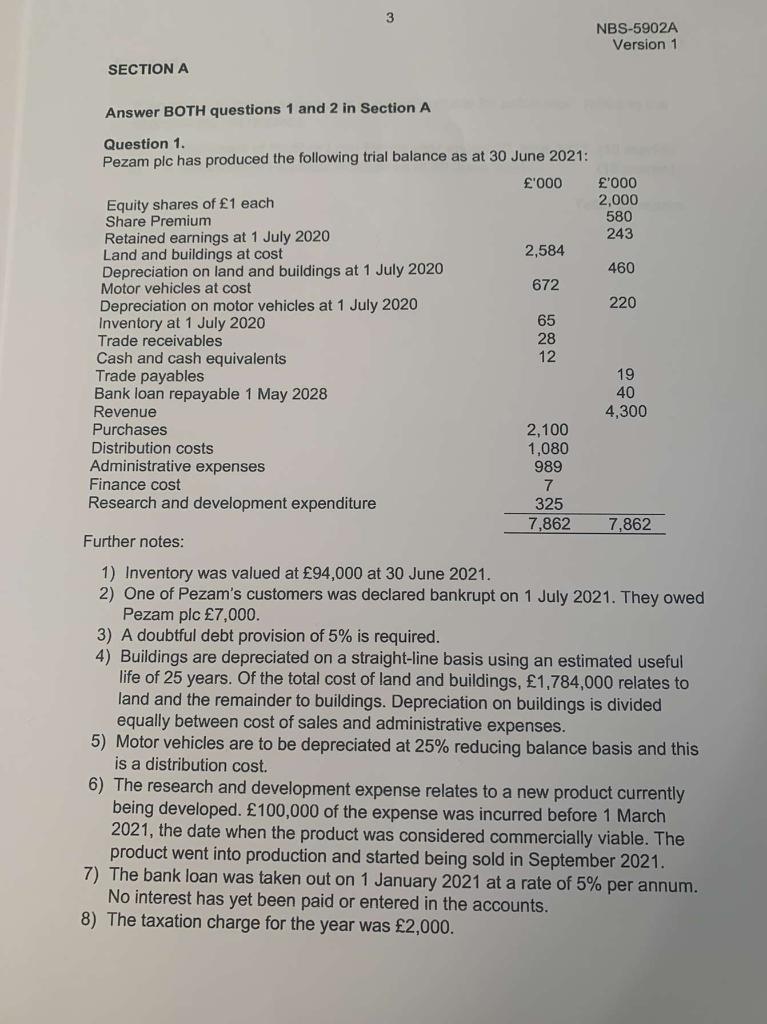

3 NBS-5902A Version 1 SECTION A Answer BOTH questions 1 and 2 in Section A Question 1. Pezam plc has produced the following trial balance as at 30 June 2021: '000 '000 2,000 Equity shares of 1 each Share Premium 580 243 Retained earnings at 1 July 2020 Land and buildings at cost 2,584 460 Depreciation on land and buildings at 1 July 2020 Motor vehicles at cost 672 Depreciation on motor vehicles at 1 July 2020 220 Inventory at 1 July 2020 65 Trade receivables 28 Cash and cash equivalents 12 Trade payables 19 Bank loan repayable 1 May 2028 40 Revenue 4,300 Purchases 2,100 Distribution costs 1,080 Administrative expenses 989 Finance cost 7 Research and development expenditure 325 7,862 7,862 Further notes: 1) Inventory was valued at 94,000 at 30 June 2021. 2) One of Pezam's customers was declared bankrupt on 1 July 2021. They owed Pezam plc 7,000. 3) A doubtful debt provision of 5% is required. 4) Buildings are depreciated on a straight-line basis using an estimated useful life of 25 years. Of the total cost of land and buildings, 1,784,000 relates to land and the remainder to buildings. Depreciation on buildings is divided equally between cost of sales and administrative expenses. 5) Motor vehicles are to be depreciated at 25% reducing balance basis and this is a distribution cost. 6) The research and development expense relates to a new product currently being developed. 100,000 of the expense was incurred before 1 March 2021, the date when the product was considered commercially viable. The product went into production and started being sold in September 2021. 7) The bank loan was taken out on 1 January 2021 at a rate of 5% per annum. No interest has yet been paid or entered in the accounts. 8) The taxation charge for the year was 2,000. 4 NBS-5902A Version 1 Required: Prepare the following statements in a form suitable for publication. Notes to the accounts are not required. a) A Statement of Profit or Loss for the year ended 30 June 2021. (10 marks) b) A Statement of Financial Position as at 30 June 2021. (15 marks) Total 25 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts