Question: 6 NBS-5902A Version 1 SECTION B Answer TWO questions in Section B Question 3. Latte Ltd prepares accounts to 31 December and on 1 January

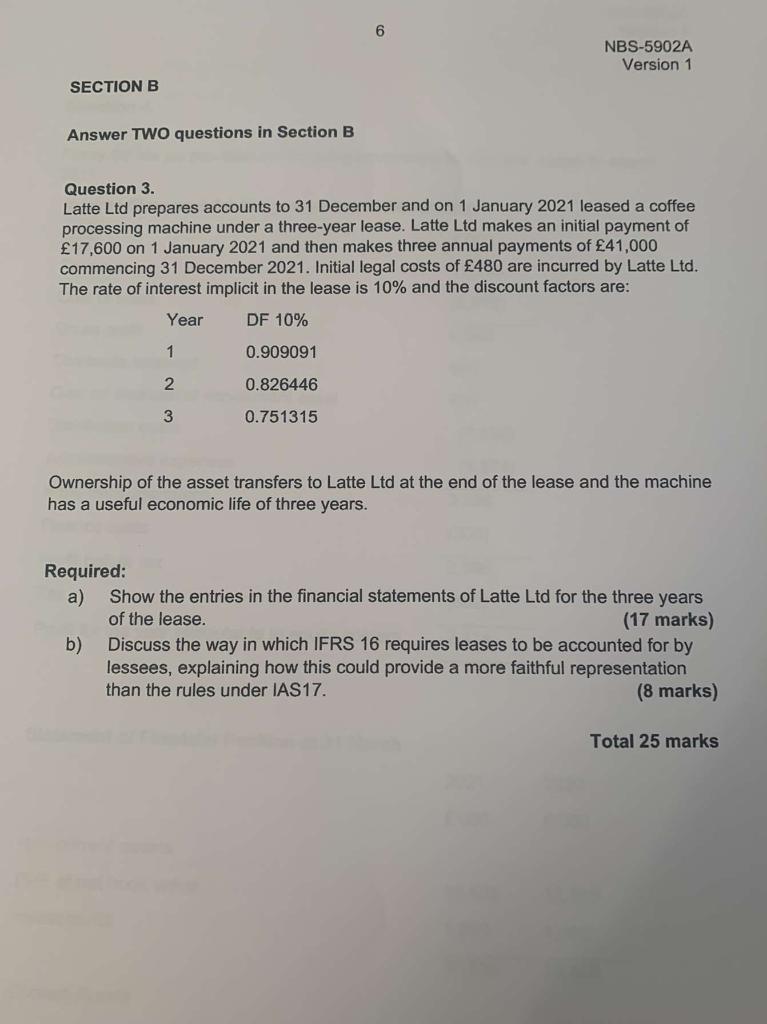

6 NBS-5902A Version 1 SECTION B Answer TWO questions in Section B Question 3. Latte Ltd prepares accounts to 31 December and on 1 January 2021 leased a coffee processing machine under a three-year lease. Latte Ltd makes an initial payment of 17,600 on 1 January 2021 and then makes three annual payments of 41,000 commencing 31 December 2021. Initial legal costs of 480 are incurred by Latte Ltd. The rate of interest implicit in the lease is 10% and the discount factors are: Year DF 10% 1 0.909091 2 0.826446 3 0.751315 Ownership of the asset transfers to Latte Ltd at the end of the lease and the machine has a useful economic life of three years. Required: a) Show the entries in the financial statements of Latte Ltd for the three years of the lease. (17 marks) b) Discuss the way in which IFRS 16 requires leases to be accounted for by lessees, explaining how this could provide a more faithful representation than the rules under IAS 17. (8 marks) Total 25 marks 6 NBS-5902A Version 1 SECTION B Answer TWO questions in Section B Question 3. Latte Ltd prepares accounts to 31 December and on 1 January 2021 leased a coffee processing machine under a three-year lease. Latte Ltd makes an initial payment of 17,600 on 1 January 2021 and then makes three annual payments of 41,000 commencing 31 December 2021. Initial legal costs of 480 are incurred by Latte Ltd. The rate of interest implicit in the lease is 10% and the discount factors are: Year DF 10% 1 0.909091 2 0.826446 3 0.751315 Ownership of the asset transfers to Latte Ltd at the end of the lease and the machine has a useful economic life of three years. Required: a) Show the entries in the financial statements of Latte Ltd for the three years of the lease. (17 marks) b) Discuss the way in which IFRS 16 requires leases to be accounted for by lessees, explaining how this could provide a more faithful representation than the rules under IAS 17. (8 marks) Total 25 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts